What You Need to Know About Metro Vancouver's Rental Market

Feb 14, 2023

Written by

Ryan BerlinSHARE THIS

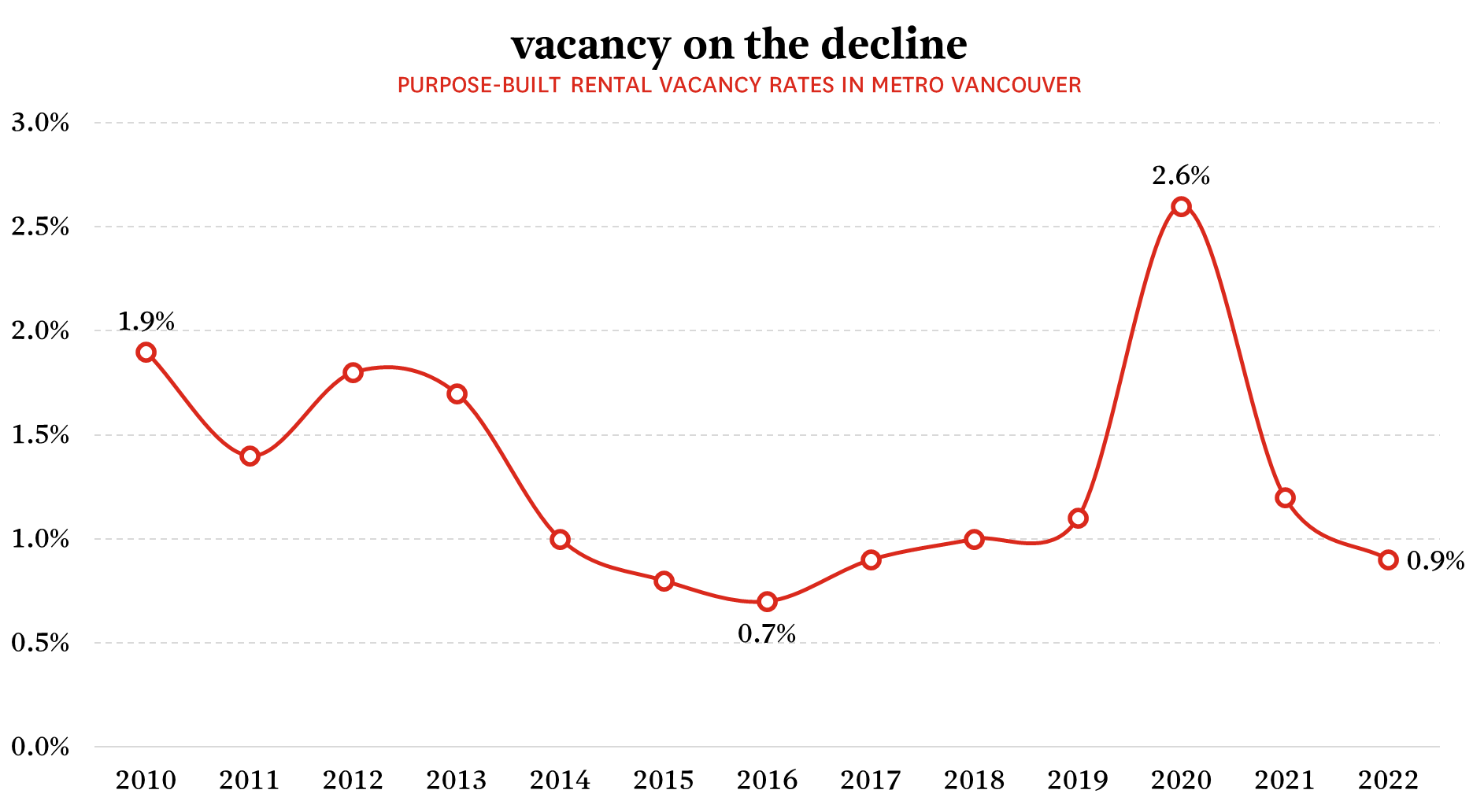

- The region’s purpose-built rental vacancy rate continued to fall in 2022: at 0.9%, it’s now lower than it was before the pandemic (1.1%).

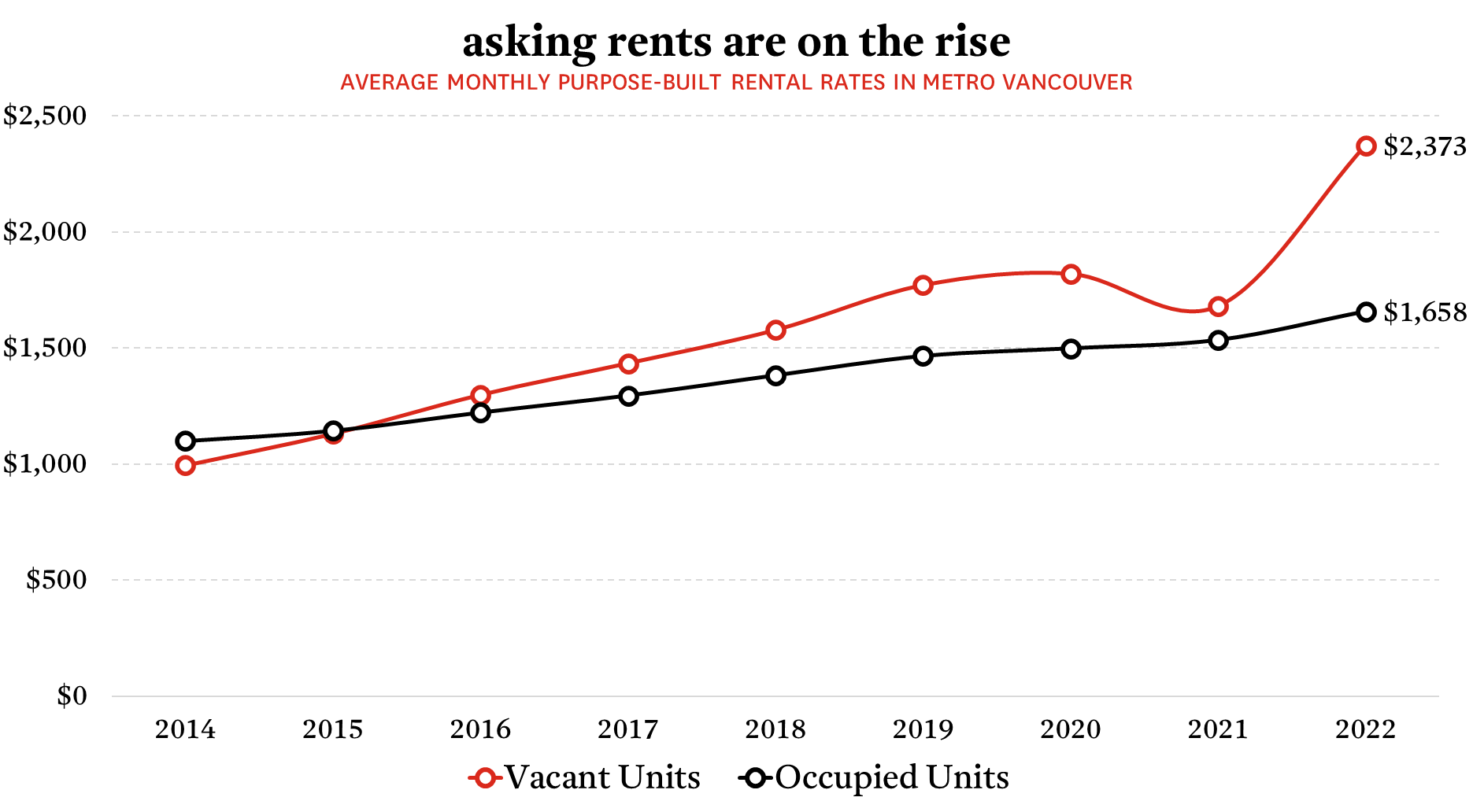

- Asking rents on vacant units are increasing much faster than rents in occupied units. By the end of 2022, the region’s average asking rent for vacant units was $2,373, compared with $1,658 in occupied units.

- The region’s stock of purpose-built rental homes is increasing at its fastest pace since CMHC first began tracking in 1990, with the stock increasing by 3,805 homes (+3.3%) between 2021 and 2022.

An Already Low Vacancy Rate Dips Even Lower

Metro Vancouver’s purpose-built vacancy rate, which was already the lowest in the country in 2021, declined in 2022 to 0.9% (from 1.2%); it now sits below both its pre-pandemic level (of 1.1%) and the 1% threshold for the first time since 2017. The low (and declining) vacancy rate reflects a number of demand- and supply-side dynamics, including a record-setting level of in-migration to Metro Vancouver and increasing affordability challenges within the ownership segment of the region’s housingmarket. Declining vacancy rates were observed throughout the region, with the majority of submarkets recording a decrease in vacancy in 2022. Only Kerrisdale (2.5%), White Rock and Central Park/Metrotown (both at 1.5%), West Vancouver (1.1%), North Vancouver (1.0%), and the University Endowment Lands (0.2%--yes, this represented an increase in the vacancy rate), recorded elevated vacancy last year.

Declining vacancy rates were observed throughout the region, with the majority of submarkets recording a decrease in vacancy in 2022. Only Kerrisdale (2.5%), White Rock and Central Park/Metrotown (both at 1.5%), West Vancouver (1.1%), North Vancouver (1.0%), and the University Endowment Lands (0.2%--yes, this represented an increase in the vacancy rate), recorded elevated vacancy last year.Rents are Increasing at an Inreasing Rate

Against the backdrop of declining vacancy rates, rental rates have been on the rise: overall, average monthly rent in Metro Vancouver increased by 8.3% between 2021 and 2022, to $1,665. This growth in rents occurred in spite of the mandated 1.5% cap on rent increases for existing tenants, being driven as it was by the turnover of rental units. The change in average asking monthly rent for vacant units, however, paints a much starker picture for those looking to secure rental accommodation in Metro Vancouver, having increased by a whopping 41% between 2021 and 2022, to $2,373. Compared to that of occupied units, the average asking rent for vacant units was 43% higher. Furthermore, the turnover rate in Metro Vancouver—-that is, the proportion of units whose occupants change—fell from 11.7% in 2021 to 10.7% in 2022, thereby illustrating the disincentive for renters to move at the margin when facing significant rent increases in the open market.

The change in average asking monthly rent for vacant units, however, paints a much starker picture for those looking to secure rental accommodation in Metro Vancouver, having increased by a whopping 41% between 2021 and 2022, to $2,373. Compared to that of occupied units, the average asking rent for vacant units was 43% higher. Furthermore, the turnover rate in Metro Vancouver—-that is, the proportion of units whose occupants change—fell from 11.7% in 2021 to 10.7% in 2022, thereby illustrating the disincentive for renters to move at the margin when facing significant rent increases in the open market.Rental Supply: More is Good, But Not Enough

Notably, Metro Vancouver’s vacancy rate declined in 2022 despite the net addition of 3,304 purpose-built rental homes between 2021 and 2022—record growth going back at least as far as 1990, which is as far back as CMHC’s available data go).Rental housing starts have been elevated over the past few years, leading to the record increase in the primary rental stock last year, as many of the homes that were previously under construction became completed. Continued growth in Metro Vancouver’s purpose-built rental stock in the years ahead is likely as well, with 2022 recording a new high for rental starts, at 9,369.While the increasing supply of purpose-built rental homes in Metro Vancouver is indeed a welcome development (no pun intended), the vacancy and rent data clearly indicate that not enough is being done to permit supply to keep up with the demands of a growing region. And with the lack of acceptable rental housing already posing a significant challenge to tenants, these challenges will only be intensified if rents continue to climb. Our rennie intelligence team comprises our in-house demographer, senior economist, and market analysts. Together, they empower individuals, organizations, and institutions with data-driven market insight and analysis. Experts in urban land economics, community planning, shifting demographics, and real estate trends, their strategic research supports a comprehensive advisory service offering and forms the basis of frequent reports and public presentations. Their thoughtful and objective approach truly embodies the core values of rennie.Written by

Ryan Berlin

Related

prices, policies, and population shifts: what’s ahead for housing? | the spring 2025 rennie landscape

Join Ryan Berlin (Head Economist and VP Intelligence) and Ryan Wyse (Market Intelligence Manager & Lead Analyst) as they break down the latest edition of the rennie landscape—our semi-annual report on the forces shaping housing markets today.

Apr 2025

Podcast

the rennie landscape | Kelowna | Spring 2025

We are pleased to present our Spring 2025 edition of the rennie landscape. Focusing on Central Okanagan, this edition of the rennie landscape examines various facets of economic and demographic change, to provide clarity on the forces shaping our housing markets and and consider what the future may hold.

Apr 2025

Report