Too Much Money Chasing Too Few Things

May 20, 2022

Written by

Ryan BerlinSHARE THIS

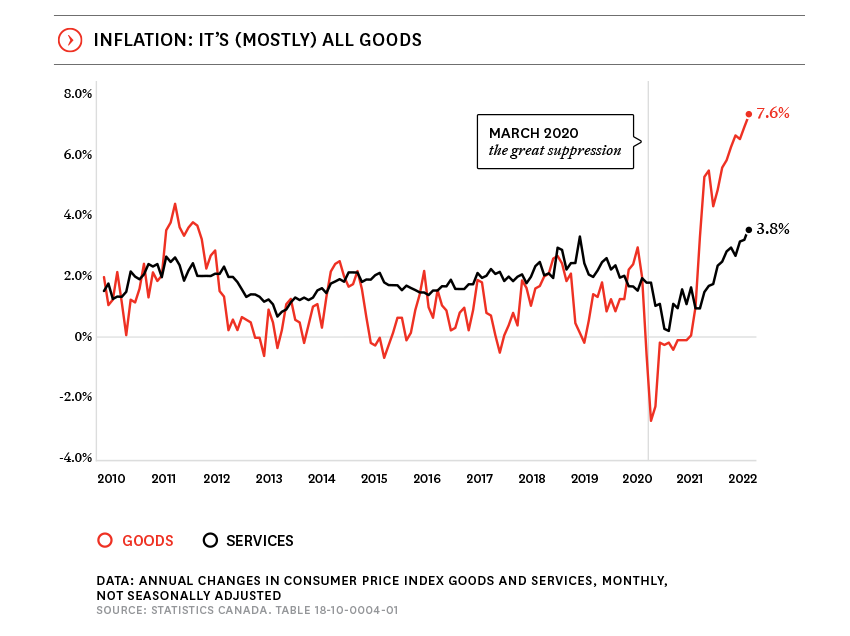

It’s horses for courses when it comes to inflation, with the price escalation experience varying significantly from coast-to-coast.Inflation isn’t as uniform and ubiquitous as it is often treated. Consumer prices rise more quickly or slowly in different parts of the country. Additionally, the specific inflation rate any one individual faces reflects their particular spending patterns, and whatever the measure of inflation, it’s always a function of how prices are changing for the individual components in the consumer price index (like lemons and consulting services). On this latter point, the annual change in the price of services in Canada has been quite stable over the past decade, oscillating between 1-3% leading up to the pandemic. Goods inflation, on the other hand, has been much more volatile—reflecting the prices of things like gasoline and food, both of which fluctuate considerably—ranging from periods of deflation to increases of up to 4.6% (again, in the decade leading up to the pandemic). Today, inflation in goods is at 7.6%, while that of services is at 3.8%. Both are uncomfortably high, but for now, headline inflation is really being driven by the demand for products whose supply chains, in many instances, are hobbled. As this glitch in the matrix is mended through this coming year, price gains will ease.

Written by

Ryan Berlin

Related

maintaining a neutral position

As was widely expected, the Bank of Canada held its trend-setting policy interest rate at 2.75% today.

Jul 2025

Article

3 min read

reading the federal reserve tea leaves

Ahead of the next Federal Reserve meeting on June 19th, we parse last meeting's minutes for the three biggest takeaways.

Jun 2025

Article

10mins read