No Wind in Our Sales

Dec 12, 2022

Written by

Ryan BerlinSHARE THIS

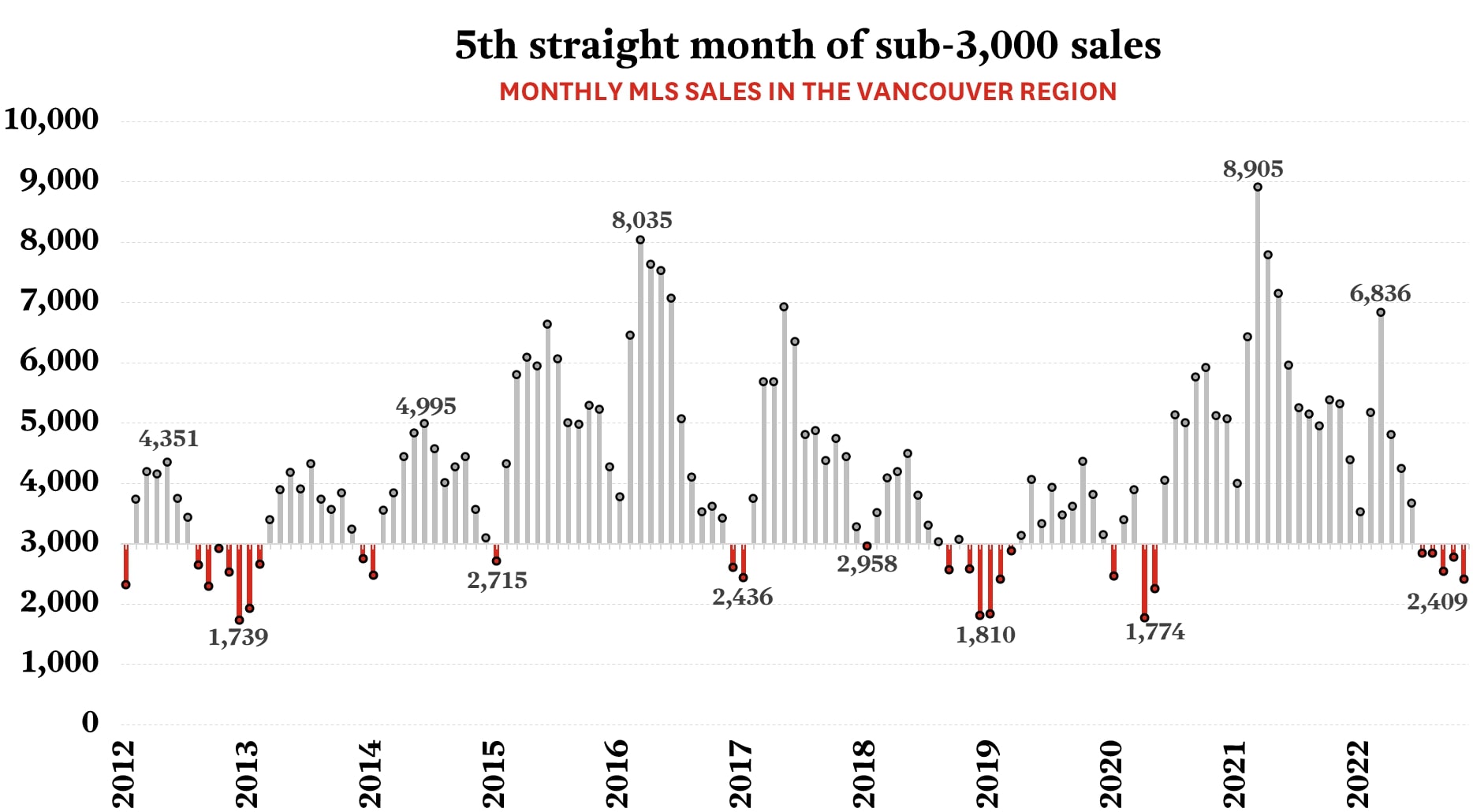

With the pace of housing market activity having declined sharply in the second half of 2022, the Vancouver Region is squarely in the midst of a dramatic slowdown—the likes of which we haven’t seen in a decade.The housing market in Metro Vancouver, like most across the country, has been characterized by muted MLS sales counts of late, brought about by interest rate hikes that themselves were triggered by persistently high inflation. Meanwhile, a robust labour market has served to keep supply in check, even as sales have slowed, as the pace of new listings has been below typical levels (being highly correlated with sales counts, this doesn’t come as a huge surprise). Overall then, housing market activity has been sluggish into the fall—a time of year that typically sees an uptick in buying and selling.Normally, MLS sales counts in this region increase between September and October, followed by a decrease in November. In keeping with this trend, sales were in fact 9% higher in October than they were in September, and then 13% lower in November, thereby aligning perfectly with the typically-observed seasonal bump. Having said that, the actual count of sales in October and November fell far short of the norm: the 2,778 transactions in October were 36% below the past 10-year October average and the 2,409 sales in November were 39% below the past 10-year November average. Furthermore, the overall regional MLS sales count failed to surpass the 3,000-mark for the fifth consecutive month—something that hasn’t happened since early 2019.The 3,000-sale threshold is one that is rarely missed in Metro Vancouver. Over the past 10 years, only 24 months failed to achieve the mark, including the most recent five.

Written by

Ryan Berlin

Related

seattle suburbs are losing their rental advantage

The rental "discount" available in traditionally more affordable Seattle submarkets is shrinking, and in some cases, have disappeared entirely.

May 2025

Article

5mins read

the kelowna rennie advance | May 2025

Another month of below-average sales and elevated new listings in April helped push inventory in the Central Okanagan closer to a new decade high. Available condo inventory has diverged from other home types and was more than 70% above long-run average levels.

May 2025

Report