Prices Will Rise by More Than Before

Oct 21, 2022

Written by

Ryan BerlinSHARE THIS

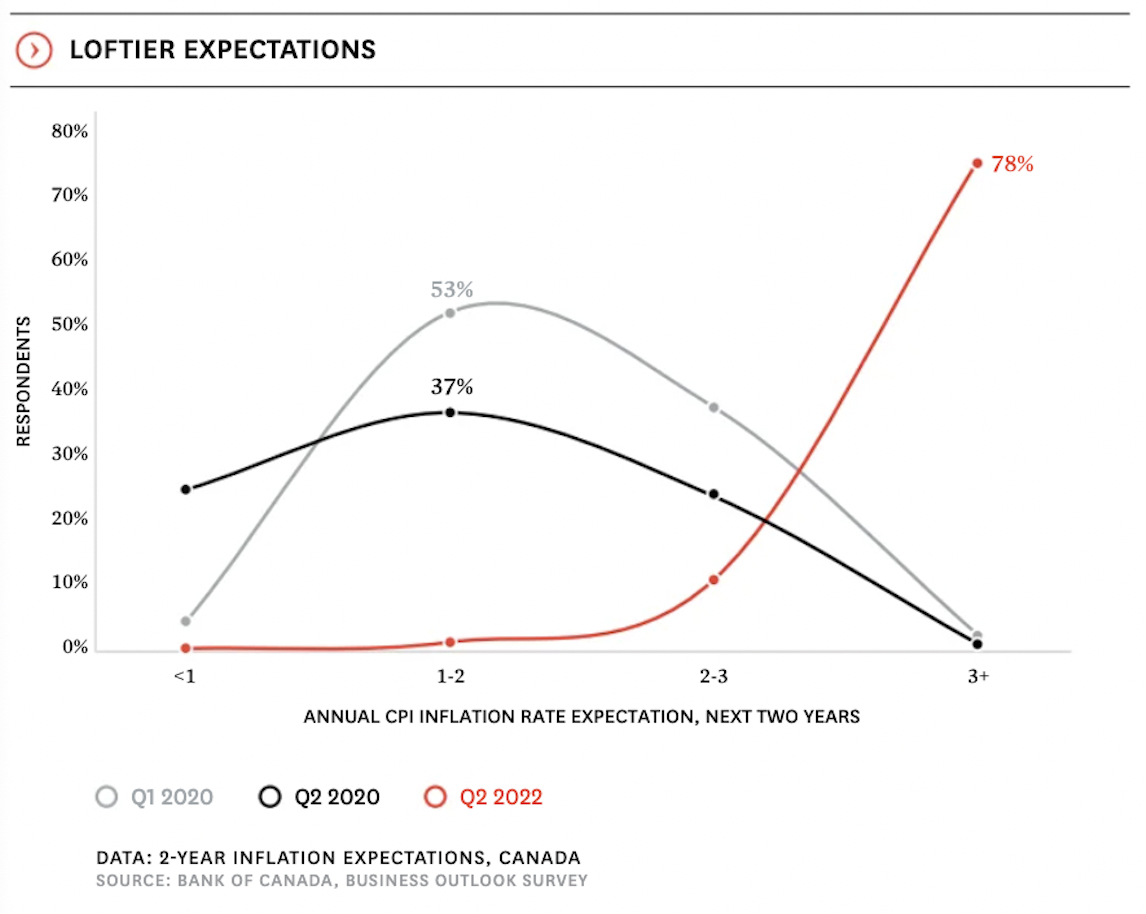

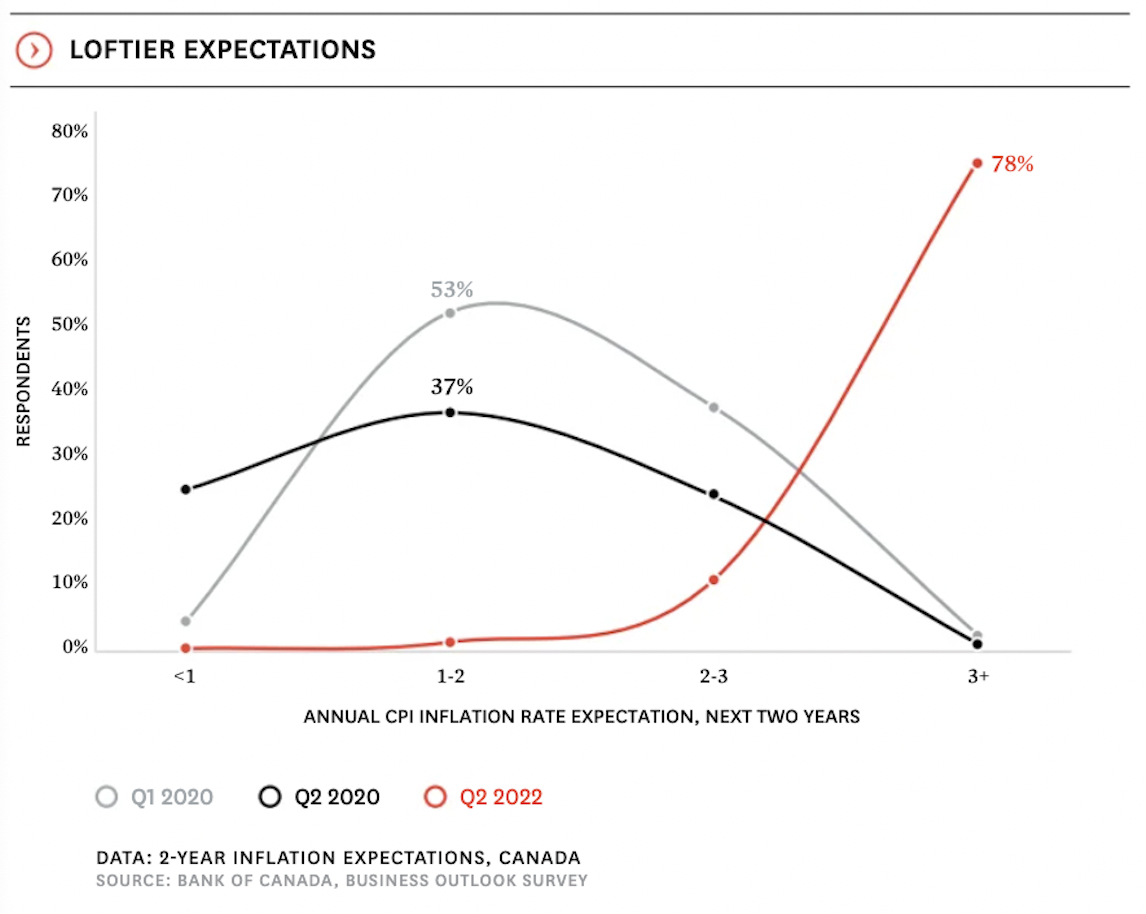

As inflation has risen in Canada, so have inflation expectations—something the Bank of Canada is keeping an eye on.Inflation expectations—that is, the extent to which households, businesses, and governments think prices will rise in thefuture—can be a self-fulfilling prophecy. If everyone thinks that everything will be 5% more expensive next year, for example,then employees will ask for, and get, 5% raises; firms will raise their prices by 5%; and everyone will ultimately spend 5% more. Consequently, the Bank of Canada monitors not only year-over-year headline inflation but other measures of price changes (including trim, common, and median inflation) and, yes, expectations of future inflation.According to a survey of Canadian businesses, inflation expectations of 3% or more for the next two years have more than doubled in the past 12 months from 35% to 78%. That an overwhelming majority of Canadian firms expect higher inflation over the next two years than they did just two years ago is notable and signals an increased risk of inflation becoming entrenched. This is yet another indication that the Bank of Canada will pursue a hawkish monetary policy through increasing interest rates and quantitative tightening in the coming months. Twice a year, rennie intelligence produces the rennie landscape, which tracks a variety of demographic and economic indicators that directly and indirectly influence our housing market here in Metro Vancouver. Our goal is to provide our community with a basis for evaluating the trajectory of the factors that collectively define the context of the real estate market.Our rennie intelligence team comprises our in-house demographer, senior economist, and market analysts. Together, they empower individuals, organizations, and institutions with data-driven market insight and analysis. Experts in urban land economics, community planning, shifting demographics, and real estate trends, their strategic research supports a comprehensive advisory service offering and forms the basis of frequent reports and public presentations. Their thoughtful and objective approach truly embodies the core values of rennie.

Twice a year, rennie intelligence produces the rennie landscape, which tracks a variety of demographic and economic indicators that directly and indirectly influence our housing market here in Metro Vancouver. Our goal is to provide our community with a basis for evaluating the trajectory of the factors that collectively define the context of the real estate market.Our rennie intelligence team comprises our in-house demographer, senior economist, and market analysts. Together, they empower individuals, organizations, and institutions with data-driven market insight and analysis. Experts in urban land economics, community planning, shifting demographics, and real estate trends, their strategic research supports a comprehensive advisory service offering and forms the basis of frequent reports and public presentations. Their thoughtful and objective approach truly embodies the core values of rennie.

Twice a year, rennie intelligence produces the rennie landscape, which tracks a variety of demographic and economic indicators that directly and indirectly influence our housing market here in Metro Vancouver. Our goal is to provide our community with a basis for evaluating the trajectory of the factors that collectively define the context of the real estate market.Our rennie intelligence team comprises our in-house demographer, senior economist, and market analysts. Together, they empower individuals, organizations, and institutions with data-driven market insight and analysis. Experts in urban land economics, community planning, shifting demographics, and real estate trends, their strategic research supports a comprehensive advisory service offering and forms the basis of frequent reports and public presentations. Their thoughtful and objective approach truly embodies the core values of rennie.

Twice a year, rennie intelligence produces the rennie landscape, which tracks a variety of demographic and economic indicators that directly and indirectly influence our housing market here in Metro Vancouver. Our goal is to provide our community with a basis for evaluating the trajectory of the factors that collectively define the context of the real estate market.Our rennie intelligence team comprises our in-house demographer, senior economist, and market analysts. Together, they empower individuals, organizations, and institutions with data-driven market insight and analysis. Experts in urban land economics, community planning, shifting demographics, and real estate trends, their strategic research supports a comprehensive advisory service offering and forms the basis of frequent reports and public presentations. Their thoughtful and objective approach truly embodies the core values of rennie.Written by

Ryan Berlin

SHARE THIS

Related

the victoria rennie review | April 2024

Greater Victoria’s housing market saw a slow start to spring with the lowest sales count for March in over a decade. Conversely, inventory has grown to its highest level for the month in almost as long.

Apr 2024

Report

the kelowna rennie review | April 2024

Recent trends of lagging sales counts across the Central Okanagan carried on in March. And while overall market conditions continue to favour buyers, pockets of the market remain notably tight - particularly for lower-priced homes.

Apr 2024

Report