purchasing power to the people

Oct 25, 2023

Written by

Ryan BerlinSHARE THIS

EVERYBODY’S WORKING FOR THE WEAKENED (WAGES)

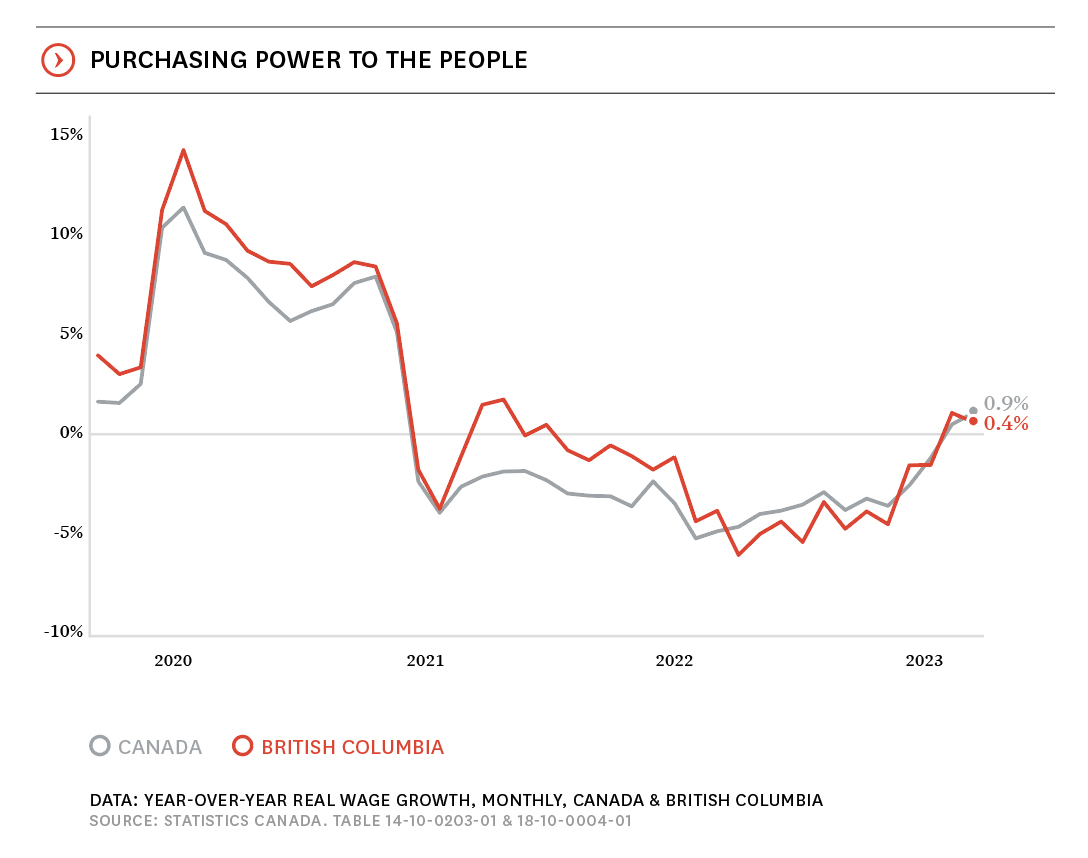

After accounting for inflation, wages are once again on the rise, having lost ground for the better part of the past 2 years.

Average weekly earnings are a useful, though imperfect, measure of how wages change over time. All measures of wages can be a tricky thing, as they depend on the earnings of those who are working at a given time. So as employment and unemployment change, that can impact average earnings even if an individual's wages remain unchanged. To wit, in 2020 average wages in 2020, both nominal and real, were rapidly increasing even though employers weren’t necessarily paying more. This was due mainly to lower-wage workers losing their jobs during lockdowns, thereby increasing the average through subtraction. Similarly, the decline in wages, resulting in negative real wage growth that was observed in early 2021 was due, in large part, to sizable gains in employment, particularly in lower-wage employment. This meant that the average was decreasing, even though individual’s incomes weren’t.

Since then, however, employment has been steadier and nominal weekly earnings have seen robust growth. Real weekly earnings, on the other hand, have been negative during that time period, as inflation has outpaced average earnings growth. This has resulted in a loss of purchasing power for the average person as costs have been rising faster than paychecks.

With inflation easing so far in 2023 (discussed in greater detail later on), real wage growth has been increasing both nationally and here in British Columbia and tipped back into positive territory in each of the past two months. Canadians, on average, have a long way to go to recoup the purchasing power they enjoyed in 2020 but they are once again seeing gains in their incomes, even relative to inflation.

Twice a year, rennie intelligence produces the rennie landscape, which tracks a variety of demographic and economic indicators that directly and indirectly influence the housing markets of Metro Vancouver, Greater Victoria, and the Central Okanagan. Our goal is to provide our community with a basis for evaluating the trajectory of the factors that collectively define the context of the real estate market.

Our rennie intelligence team comprises our in-house demographer, senior economist, and market analysts. Together, they empower individuals, organizations, and institutions with data-driven market insight and analysis. Experts in urban land economics, community planning, shifting demographics, and real estate trends, their strategic research supports a comprehensive advisory service offering and forms the basis of frequent reports and public presentations. Their thoughtful and objective approach truly embodies the core values of

.

Written by

Related

Join Ryan Berlin (Head Economist and VP Intelligence) and Ryan Wyse (Market Intelligence Manager & Lead Analyst) as they break down the latest edition of the rennie landscape—our semi-annual report on the forces shaping housing markets today.

Apr 2025

Podcast

We are pleased to present our Spring 2025 edition of the rennie landscape. Focusing on Central Okanagan, this edition of the rennie landscape examines various facets of economic and demographic change, to provide clarity on the forces shaping our housing markets and and consider what the future may hold.

Apr 2025

Report