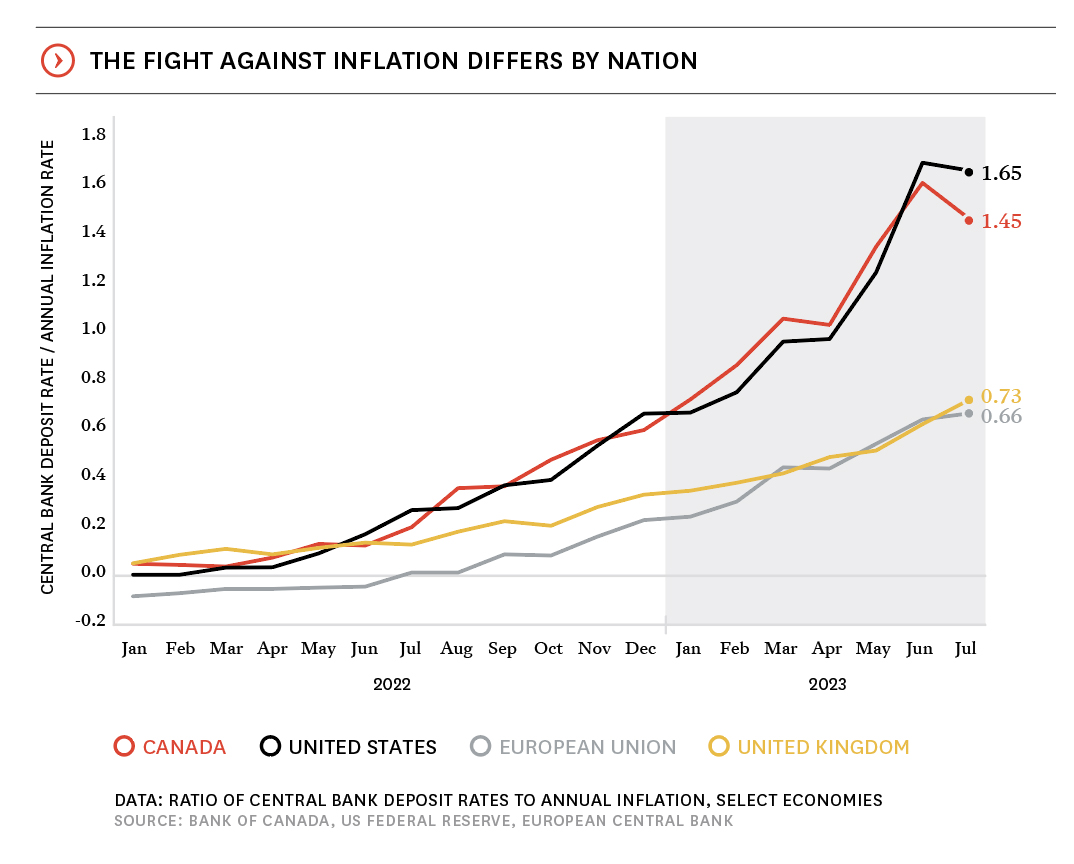

the fight against inflation differs by nation

Nov 01, 2023

Written by

Ryan BerlinSHARE THIS

NORTH AMERICAN HAWKS & EUROPEAN DOVES

High inflation has affected nations across the globe, though to varying degrees. A mix of demand-side factors, including covid-era ultra-low interest rates, and supply-side factors including global supply chain issues were among the reasons that inflation was so ubiquitous around the world. And while all central banks had to first stimulate their economies in the face of covid, then grapple with high inflation, their methods for each vary.

While Canada went to a near-zero deposit rate in 2020 at 0.25%, and the US actually went to 0.00%, the UK went to 0.10%, and the EU, meanwhile, went negative to -0.50%. These differing rates, along with the respective decisions on when to start hiking likely had some impact on the runup in inflation in 2021 and 2022. Canada and the US both started to increase in March 2022 and the EU waited until July and the UK December. Inflation rates in Canada and the US peaked in June at 8.1% and 9.1%, respectively. Canada and the US now both have higher interest rates than inflation rates, while the EU lags behind at a 3.50% interest rate and inflation of 5.3%, while the UK is at a 5.00% interest rate and a 6.9% inflation rate.

Twice a year, rennie intelligence produces the rennie landscape, which tracks a variety of demographic and economic indicators that directly and indirectly influence the housing markets of Metro Vancouver, Greater Victoria, and the Central Okanagan. Our goal is to provide our community with a basis for evaluating the trajectory of the factors that collectively define the context of the real estate market.

Our

comprises our in-house demographer, senior economist, and market analysts. Together, they empower individuals, organizations, and institutions with data-driven market insight and analysis. Experts in urban land economics, community planning, shifting demographics, and real estate trends, their strategic research supports a comprehensive advisory service offering and forms the basis of frequent reports and public presentations. Their thoughtful and objective approach truly embodies the core values of

.

Written by

Related

A mixed jobs report may limit further declines in mortgage rates this year, but it could also impart confidence on the Desert’s housing market as the active season gets underway.

Feb 2026

Report

Population growth in Greater Kelowna last year fell to a more-than-decade-low in absolute terms, and more than a two-decade-low in percentage terms. While tighter immigration policy has weighed on growth across Canada, for Kelowna, lower domestic migration was the bigger factor.

Feb 2026

Report