the great hunkering

Nov 15, 2023

Written by

Ryan BerlinSHARE THIS

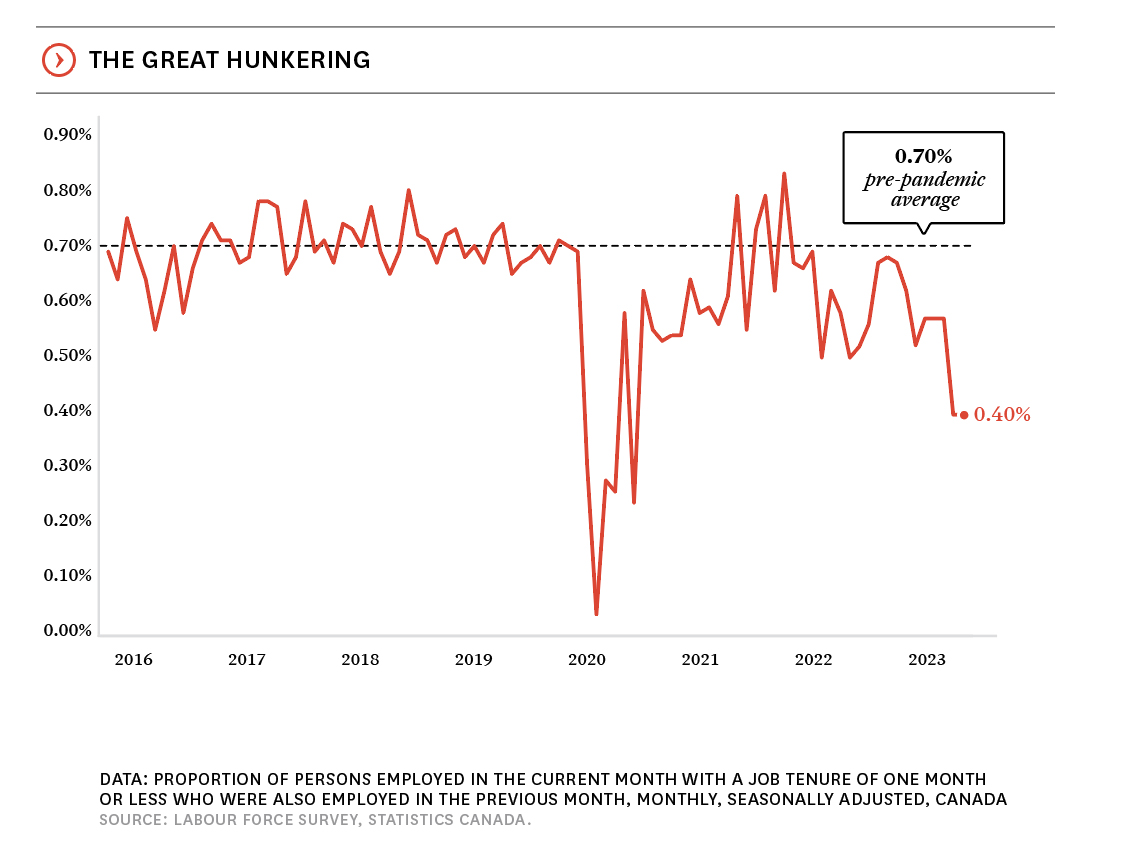

Canada’s job-changing rate provides a window into a labour market where workers are choosing to stay in their current jobs—a significant shift from last year.

STAYING PUT IN ANTICIPATION OF TOUGHER TIMES?

The “Great Resignation” was the notion that Canadians were choosing to quit their jobs in favour of new (and often higher-paying) positions in greater numbers than they had historically. To get a sense of how much job-switching has actually been occurring, and whether it’s been declining more recently, we turn to the job-changing rate. This represents the proportion of working people in a new job who’d also been working in the month prior (so it does not include those who quit to take a few months off before re-entering the workforce).

From the beginning of 2016 to February 2020, the job-changing rate averaged 0.70% per month, which is much higher than it’s been in the months since. In fact, only a short period—from August 2021 to January 2022—saw more job changing than the historical norm. This suggests that the notion of mass job-switching was likely overstated. More recently, however, there has been a clear trend of declining job-changing. That this follows a softening labour market makes sense, because in tougher times people are more likely to hang on to the jobs they have, rather than seek out new ones and we expect the rate to stay low for the time being.

Twice a year, rennie intelligence produces the rennie landscape, which tracks a variety of demographic and economic indicators that directly and indirectly influence the housing markets of Metro Vancouver, Greater Victoria, and the Central Okanagan. Our goal is to provide our community with a basis for evaluating the trajectory of the factors that collectively define the context of the real estate market.

Our rennie intelligence team comprises our in-house demographer, senior economist, and market analysts. Together, they empower individuals, organizations, and institutions with data-driven market insight and analysis. Experts in urban land economics, community planning, shifting demographics, and real estate trends, their strategic research supports a comprehensive advisory service offering and forms the basis of frequent reports and public presentations. Their thoughtful and objective approach truly embodies the core values of

Written by

Related

Our annual compendium of housing, demographic, and economic predictions for the year ahead. Read now >

Feb 2026

Report

Recent tech layoffs have impacted Seattle, pushing the local unemployment rate above the national.

Feb 2026

Article

5mins read