The Office-ial Employment Figures Are In

May 13, 2022

Written by

Ryan BerlinSHARE THIS

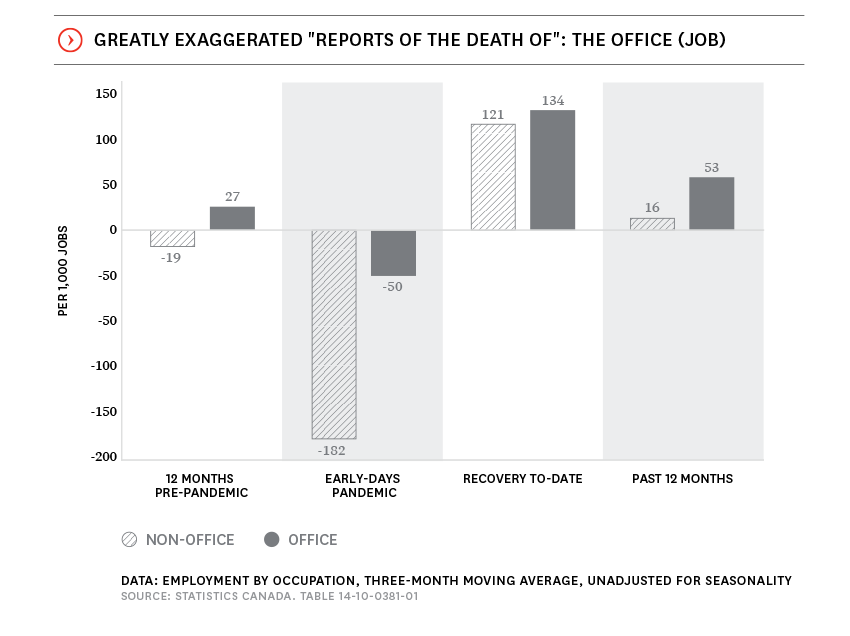

The benefits of working remotely were never made clearer than during the worst of the pandemic. It seems the benefits of office-based working are clear now, too.Statistics Canada doesn’t maintain official estimates of “office-based” employment. On the one hand, this makes it difficult to objectively assess how the pandemic impacted such white-collar jobs; on the other hand, it provides us dataphiles with an opportunity to problem-solve.Using data on occupations (that is, classifying people by what they do as part of their jobs— as opposed to what their employer produces, which defines industry classifications of employment), we’ve grouped employment into office and non-office roles and examined how these two broad groups of jobs have been faring over the past couple of years.Interestingly—considering the popular narrative around office-based employment evolving into something of a relic—the data for Metro Vancouver show that office-based employment has not only been resilient over the past two years, but it has grown by more than non-office roles.Specifically, this region lost only 50,000 office-based jobs in the first few months of the pandemic, versus 182,000 jobs lost in the rest of the economy. And since then, office-based employment has grown by 134,000 jobs versus 121,000 in non-office environments. In the last year, 53,000 jobs have been added in office-based settings compared to only 16,000 elsewhere.

Written by

Ryan Berlin

Related

why buyers are waiting and sellers are still listing in the Sea-to-Sky

Join Ryan Berlin (Head Economist and VP Intelligence), Ryan Wyse (Market Intelligence Manager and Lead Analyst), and rennie advisor Carleigh Hofman as they examine how the housing market is closing out 2025 across Metro Vancouver, Squamish, and Whistler. They discuss near-record-low sales, elevated listings, shifting labour market signals, and what interest rates may do next. Carleigh shares on-the-ground insight into who is buying, who is selling, and why the Sea-to-Sky corridor continues to behave differently than the broader region.

Dec 2025

Podcast

does AI know more about real estate than we do?

Join Ryan Berlin, Head Economist and VP Intelligence, and Darrell Koopmans, VP Technology, as they look at how artificial intelligence is showing up across real estate and the wider economy. They discuss what AI actually is, how consumers and advisors are using it, and where it adds value in forecasting, analysis, and workflow automation. They also explore the limits of black box models, why human insight still matters, and how rennie is integrating AI in a thoughtful and practical way.

Dec 2025

Podcast