What You Need to Know About The Path Ahead for Inflation

Feb 21, 2023

Written by

Ryan BerlinSHARE THIS

- Canada’s most recent inflation rate of 5.9% (as of January 2023) is still well outside the Bank of Canada’s target range of 1% to 3%.

- The pace of inflation in Canada has been on the decline for the past six months, having peaked at 8.1% in June 2022.

- The annual rate of inflation in Canada is likely to continue to decline in the coming months and trend back into the Bank of Canada’s target range.

What is Inflation?

Statistics Canada calculates the official rate of inflation as the annual rate of change in the Consumer Price Index (CPI). The CPI has been constructed based on a “basket of goods and services” that seeks to represent the typical spending patterns of Canadians.The Bank of Canada has a mandate to maintain the rate of inflation at an average of 2% per year, and to keep it within a range of 1% to 3% annually. With the rate of inflation having exceeded the Bank’s target range in each month since April 2021, it has prompted the Bank to take action in the form of increasing its short-term (overnight) policy interest rate, which in turn affects a range of debt products, including savings accounts, lines of credit, auto and student loans, and variable-rate mortgages. The purpose of this action is to disincentivize spending/borrowing and incentivize saving; in turn, this has the effect of reducing pressure on prices of goods and services to rise.How is Inflation Calculated?

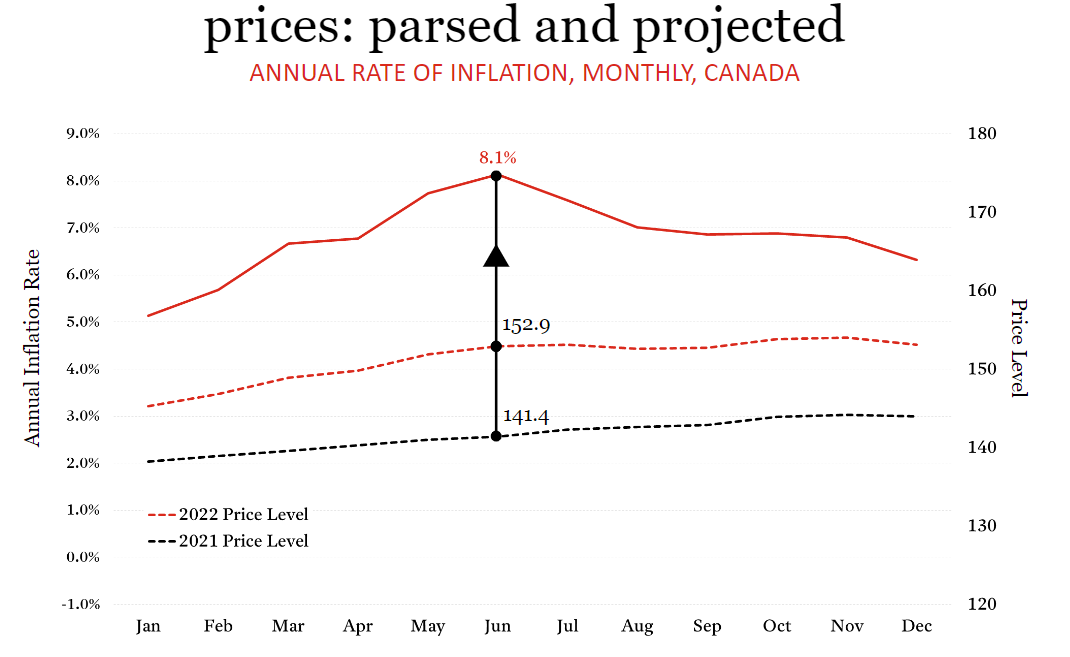

When calculating the rate of inflation, there are essentially two numbers to consider. The first, obviously, is where prices are (or the CPI is) today. The second—which holds an equal weight to today’s prices in the calculation of inflation—is where prices were (or the CPI was) one year ago. The relative change in these numbers is what yields the headline rate of inflation, which can be slowing even as current prices are rising. This was the case in the second half of 2022, when the price level (CPI) was rising, but the annual rate of inflation was decreasing as the gap between the 2022 price level and the 2021 price level narrowed.

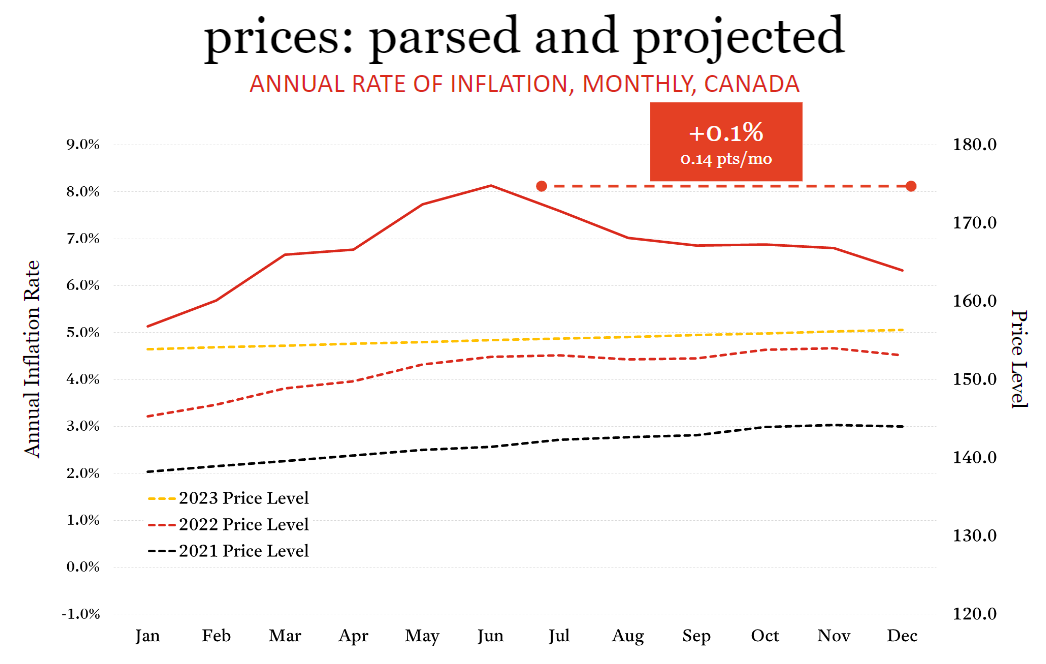

The 2022 Price Level Informs Inflation in 2023

Notably, last year was atypical not simply because of the high rate of annual inflation we experienced, but because our experience with inflation was so different in the first half of 2022 compared to the second half. Most of the price increases last year came in the first six months, during a time of ongoing supply chain disruptions, rising home prices coupled with rising interest rates, rising rents, a war that caused increases in oil and gas prices, wheat prices, and fertilizer prices to name a few. The second half of the year, however, was characterized more by improvements in supply chains, lower oil and gas prices, declining home prices, and rents increasing more slowly. In fact, the average month-to-month increase to the CPI in the second half of 2022 was just 0.1% as shown on the chart below. So while prices overall continued to rise each month in the second half of 2022 (with the exception of December, when the CPI dipped below November's level), they did so at a much slower pace than in the first half, yielding a slowdown in the annual rate of inflation. Importantly, this uneven path of month-to-month inflation in 2022 will have implications for the rate of inflation in 2023.Indeed, it’s a similar set of conditions we find ourselves in to start this year—one where we expect prices (which are already high relative to two years ago) to continue to rise, albeit at a pace similar to the second half of last year. Because prices rose so sharply in the first half of last year—and if prices do rise relatively modestly in the coming months—the gap between the 2022 price level and the 2023 price level will continue to close, resulting in the annual rate of inflation declining further. In the below chart, we show the “inertia scenario” for inflation, which is the path inflation would follow if prices continue to rise at the average monthly pace they did in the second half of 2022.

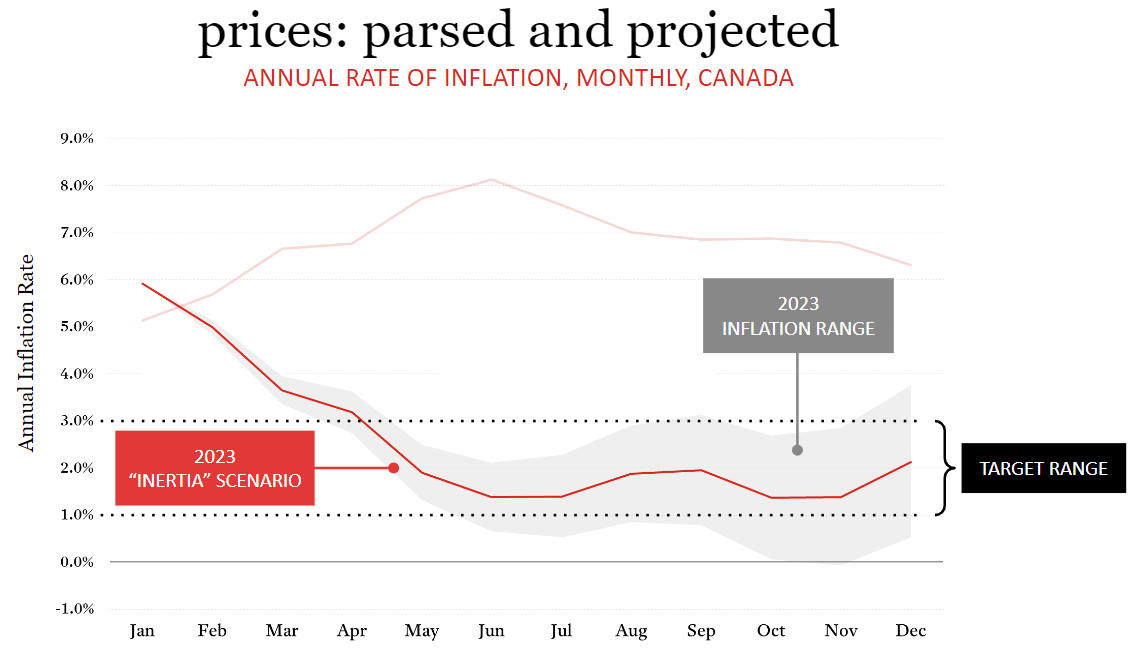

So while prices overall continued to rise each month in the second half of 2022 (with the exception of December, when the CPI dipped below November's level), they did so at a much slower pace than in the first half, yielding a slowdown in the annual rate of inflation. Importantly, this uneven path of month-to-month inflation in 2022 will have implications for the rate of inflation in 2023.Indeed, it’s a similar set of conditions we find ourselves in to start this year—one where we expect prices (which are already high relative to two years ago) to continue to rise, albeit at a pace similar to the second half of last year. Because prices rose so sharply in the first half of last year—and if prices do rise relatively modestly in the coming months—the gap between the 2022 price level and the 2023 price level will continue to close, resulting in the annual rate of inflation declining further. In the below chart, we show the “inertia scenario” for inflation, which is the path inflation would follow if prices continue to rise at the average monthly pace they did in the second half of 2022.Where is Inflation Likely Headed?

We made our formal inflation prediction (along with a host of other forecasts) in the 2023 edition of the rennie outlook. In summary, we see a path for inflation that would involve it returning to the Bank of Canada’s target range of 1% to 3% sometime in the spring, and then remaining in that range for the balance of 2023.

It’s this predicted path for inflation that informs our predictions for interest rates, and in turn for our local housing market. While we don’t expect goods and services to get any cheaper any time soon, a return to stable inflation, even in a high interest rate environment, will offer more certainty to consumers and businesses and allow them to plan their spending and investments accordingly.Our rennie intelligence team comprises our in-house demographer, senior economist, and market analysts. Together, they empower individuals, organizations, and institutions with data-driven market insight and analysis. Experts in urban land economics, community planning, shifting demographics, and real estate trends, their strategic research supports a comprehensive advisory service offering and forms the basis of frequent reports and public presentations. Their thoughtful and objective approach truly embodies the core values of rennie.

Written by

Ryan Berlin

Related

between a rate cut and a hard place

After delivering three consecutive rate cuts in the final quarter of 2024, the Federal Reserve has opened 2025 on a decidedly different note with back-to-back pauses.

Mar 2025

Article

5mins read

trade tiff spurs Bank’s Tiff into action

The Bank of Canada cut its policy interest rate this morning, to 2.75%. More cuts are needed.

Mar 2025

Article

5 min read