the rennie advance - August 2022

Aug 02, 2022

Written by

Ryan BerlinSHARE THIS

Sales activity in the Vancouver Region continued to slow for the fourth-consecutive month in July, while inventory declined for the first time in 6 months. This series of events has created balanced conditions in the overall market, and conditions favouring buyers’ in the region’s detached home market, both for the first time since spring 2020.SalesMLS sales declined in July to 2,850, which was the fourth-consecutive monthly decrease. Sales were 23% lower than in June and exceeded the typical seasonal decline (8%). Daily sales averaged 140, 40% below July’s 2021 daily average sales. Last month’s sales were also the lowest of any month since May 2020 and were 38% below the decade-average for July.

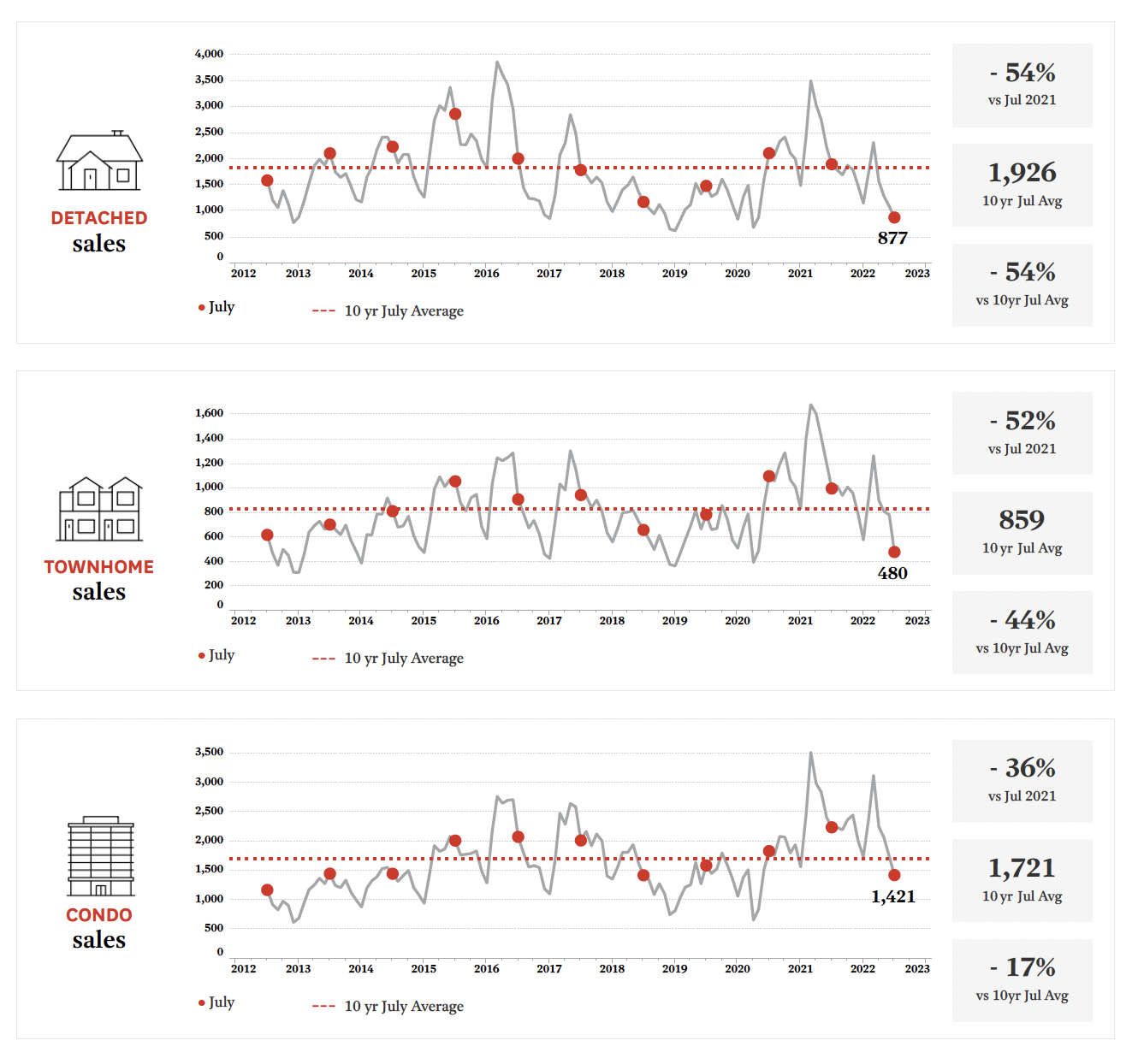

Sales declined across all home types vs June, with townhome sales falling the most at 39% (to 480), followed by detached home and condo sales declining by 20% (to 877) and 18% (to 1,421), respectively. Like total sales, last month’s sales across all home types were the lowest since May 2020.

On a year-over-year basis, sales across all home types were (expectedly) down across all home types. Detached sales experienced the largest decline of 54%, closely followed by townhome sales at 52%, and condo sales fell by 36%. Total ListingsTotal inventory declined for the first time in 6 months to 15,975 listings which were 1.8% lower than June. Inventory remains constrained as it lies 17% below the July past decade-average listings count.

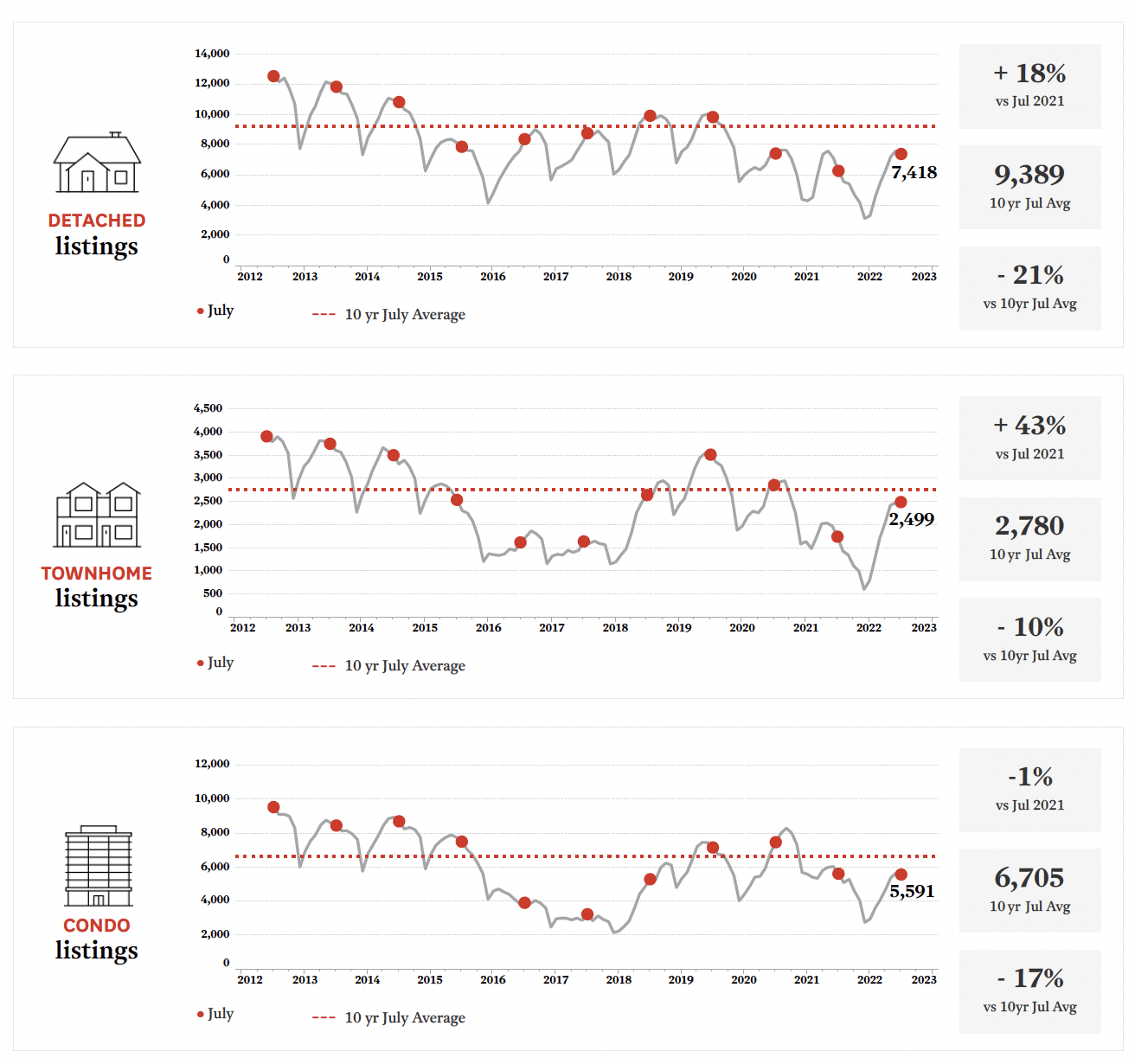

Total ListingsTotal inventory declined for the first time in 6 months to 15,975 listings which were 1.8% lower than June. Inventory remains constrained as it lies 17% below the July past decade-average listings count.

On a month-to-month basis, listings fell across all home types. Detached home listings declined by 3% (to 7,418), condo listings fell by 1.5% (to 5,591), and townhome listings were down by 0.5% (to 2,499). Compared to July 2021, detached home and townhome listings were up by 18% and 43%, respectively, whereas condo listings were down 0.8%.

July’s total sales-to-listings ratio declined between June and July to 17%, creating balanced market conditions for the first time since May 2020. Sales-to-listings ratios fell to 12%, 19%, and 25% for detached homes, townhomes and condos, respectively. This made the detached home market a buyer’s market in July, conditions last experienced in April 2020. Median PricesOn a month-to-month basis, median MLS sales prices in the Greater Vancouver and the Fraser Valley board areas declined across all home types. In the Greater Vancouver board area, detached homes median prices declined by 3%, townhomes by 4%, and condos by 0.8%. In the Fraser Valley board area, median prices declined by 4%, 1.8%, and 0.9% for detached homes, townhomes, and condos, respectively.

Median PricesOn a month-to-month basis, median MLS sales prices in the Greater Vancouver and the Fraser Valley board areas declined across all home types. In the Greater Vancouver board area, detached homes median prices declined by 3%, townhomes by 4%, and condos by 0.8%. In the Fraser Valley board area, median prices declined by 4%, 1.8%, and 0.9% for detached homes, townhomes, and condos, respectively.

Despite the monthly declines, median MLS sales prices in both the Greater Vancouver and Fraser Valley Board areas remained above July 2021 across all home types. Detached home median prices were 9% and 8% higher, while townhomes were up 11% and 15%; and condos 7% and 19% for the Greater Vancouver board area and the Fraser Valley board area, respectively. Our rennie intelligence team comprises our in-house demographer, senior economist, and market analysts. Together, they empower individuals, organizations, and institutions with data-driven market insight and analysis. Experts in urban land economics, community planning, shifting demographics, and real estate trends, their strategic research supports a comprehensive advisory service offering and forms the basis of frequent reports and public presentations. Their thoughtful and objective approach truly embodies the core values of rennie.

Our rennie intelligence team comprises our in-house demographer, senior economist, and market analysts. Together, they empower individuals, organizations, and institutions with data-driven market insight and analysis. Experts in urban land economics, community planning, shifting demographics, and real estate trends, their strategic research supports a comprehensive advisory service offering and forms the basis of frequent reports and public presentations. Their thoughtful and objective approach truly embodies the core values of rennie.

Written by

Related

New listings in the Vancouver Region surpassed 99,000 last year, the highest in at least two decades, and sales settled at a little more than 35,000, the fewest over that period. Considering how broad and diverse the region is, activity varied considerably across its 29 sub-markets.

Jan 2026

Report

Benchmark price infographics for detached homes, townhomes, and condos are available for sub-markets in the Vancouver Region, Greater Victoria, and Central Okanagan regions.

Jan 2026

Report