the rennie advance - January 2023

Jan 03, 2023

Written by

Ryan BerlinSHARE THIS

Dulled demand and scarce supply once again characterized Vancouver’s housing market dynamics in December, with the continued lack of clarity about the path of inflation and interest rates reducing sales counts to their lowest level since 2008 and thrusting inventory below 10,000 for the first time in almost a year.Sales

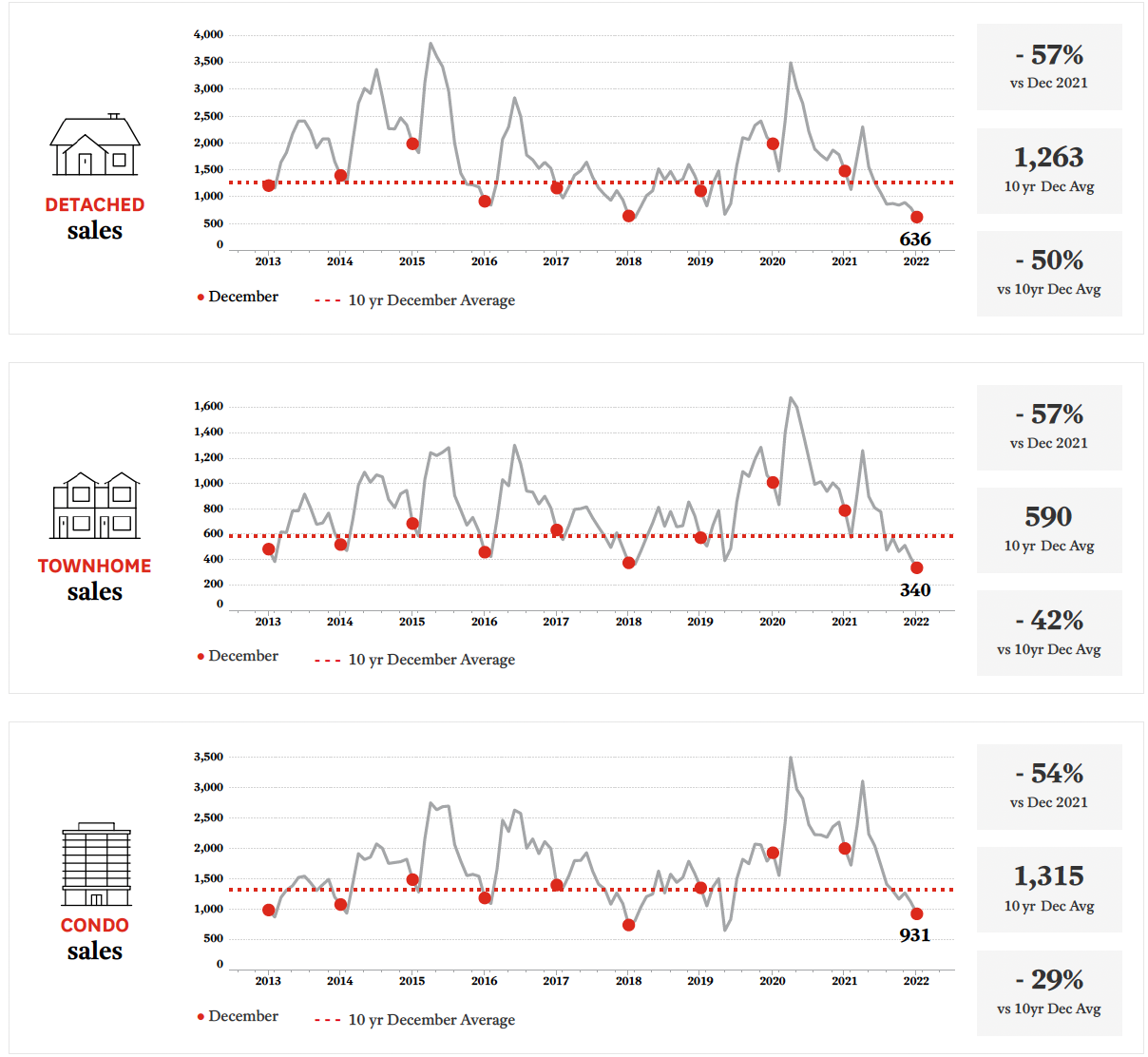

- The Vancouver Region tallied only 1,963 MLS sales in December 2022, representing the 9th consecutive month of declining sales counts in the metro area. This was the lowest sales count of any December in over 20 years, save for 2008 (in the midst of the credit crisis), and was 39% below than the past-decade December average.

- Notably, the November-to-December sales drop of 18% was entirely seasonal (with the past-decade month-over-month decline in sales at the end of the year also equalling 18%). Detached home sales fell off the most, at 21%, followed by townhomes at 18%, and condos at 17%.

- For the full year 2022, there were 43,624 MLS sales in the Vancouver Region, 38% less than 2021’s record count of 70,644, and 14% below the past-decade average of 50,999.

- Inventory continued its typical pattern year-end shrinkage into December, as last month wrapped with 10,876 listings, down 21% versus November. With sales counts depressed, this month-to-month change was actually less than the typical 26% drop in inventory at this time of year. December’s inventory was 10% below the past-decade average for the month.

- Of particular note is the significant drop in the region’s listing count between December 31st and January 1st of the new year. To wit, while there is usually a 600-700 listing decline between these two dates due to expirations and cancellations, this year saw a one-day drop of 1,304, meaning 2023 kicked off with only 9,572 homes available for purchase.

- The region’s housing market was, overall, balanced in December, with 5.5 months of inventory (MOI). The detached home market remained balanced with 7.5 MOI, while the townhome and condo segments continued to favour sellers, with MOIs of 4.6 and 4.4, respectively.

Median Prices

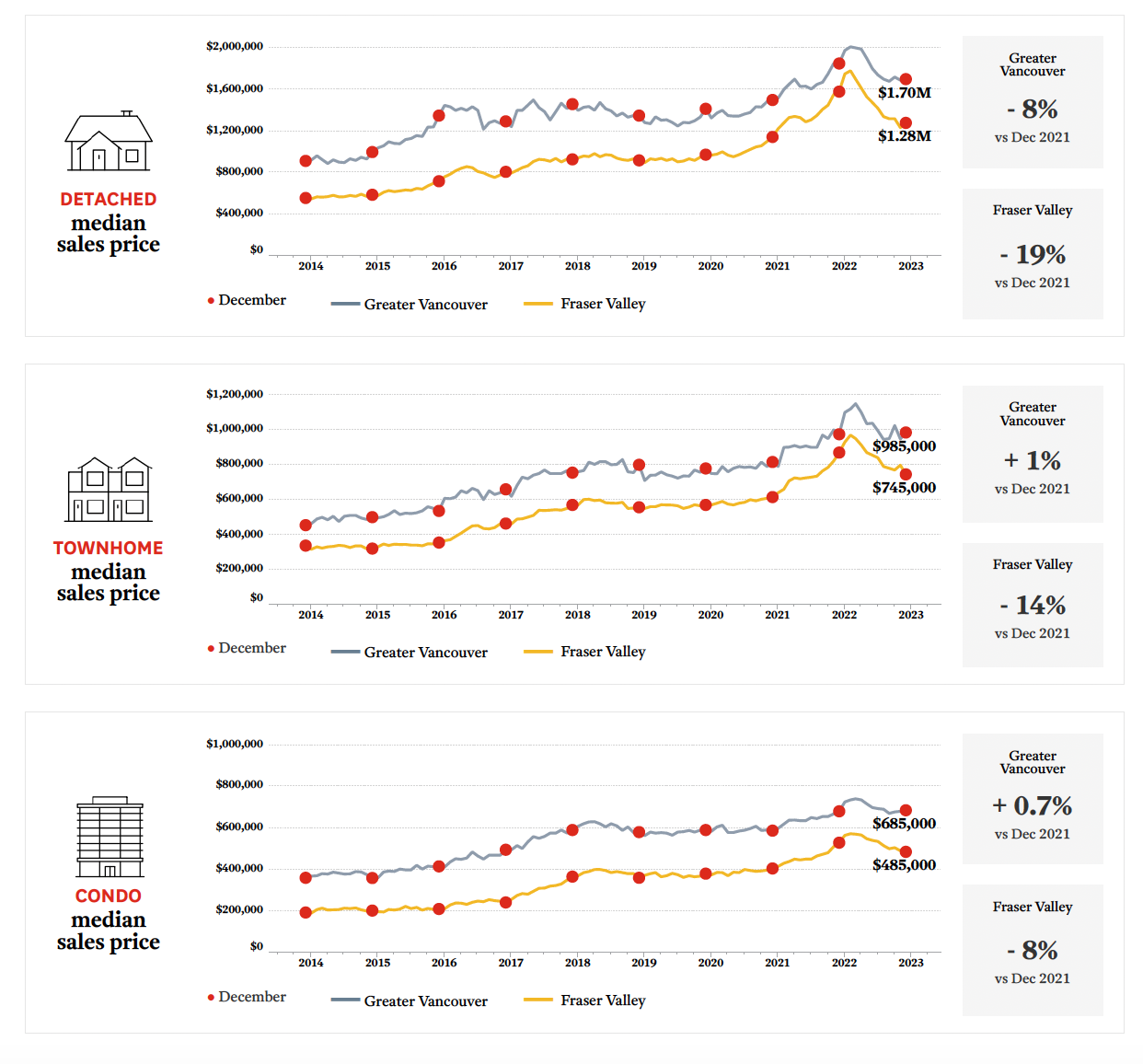

- December’s median sold prices, when averaged across all home types, increased by 1.7% versus November in the Greater Vancouver board area, while in the Fraser Valley board area they fell by 1.3%.

- Compared to November, the median sold price of townhomes in Greater Vancouver rose by 4%, with that of condos and detached homes inching up by 0.7% and 0.6%, respectively. The Fraser Valley saw an equivalent rise in the median sold price of detached homes (4%) as in Greater Vancouver, while townhomes and condos experienced respective declines in median sold prices of 7% and 1.0%.

- On a year-over-year basis in December, the price of detached homes was down in both board areas—by 8% in Greater Vancouver and by 19% in the Fraser Valley. Townhome median prices were up in Greater Vancouver by 1.0%, but down in the Fraser Valley (by 14%). Similarly, condo median prices were higher in Greater Vancouver by 0.7%, but lower by 8% in the Fraser Valley.

Our rennie intelligence team comprises our in-house demographer, senior economist, and market analysts. Together, they empower individuals, organizations, and institutions with data-driven market insight and analysis. Experts in urban land economics, community planning, shifting demographics, and real estate trends, their strategic research supports a comprehensive advisory service offering and forms the basis of frequent reports and public presentations. Their thoughtful and objective approach truly embodies the core values of rennie.

Written by

Ryan Berlin

Related

the victoria rennie review | February 2026

Population growth in Greater Victoria in 2025 fell to levels not seen since 2011. While more restrictive federal immigration policy and lower international migration were major contributors, so too was reduced domestic migration.

Today

Report

the seattle rennie review | February 2026

Concerns about job security in Greater Seattle, combined with volatility in financial markets, are weighing on would-be home buyers even as inventory rebounds and borrowing costs have eased.

Feb 2026

Report