the rennie advance - October 2022

Oct 04, 2022

Written by

Ryan BerlinSHARE THIS

September’s low sales counts and diminished inventory have left us green with envy for the day when supply can rise to meet the needs of would-be buyers in the Vancouver Region. The good news is that summer has come and passed with overall conditions remaining balanced for a third consecutive month.SalesSeptember was a slow month for MLS sales in the Vancouver Region. Specifically, last month’s 2,549 sales were 10% below August’s count (exceeding the typical month-to-month decline of 3%), 48% lower than in September 2021, and 36% below the past-decade September average. Additionally, they were the fewest number of sales in any September since 2012.

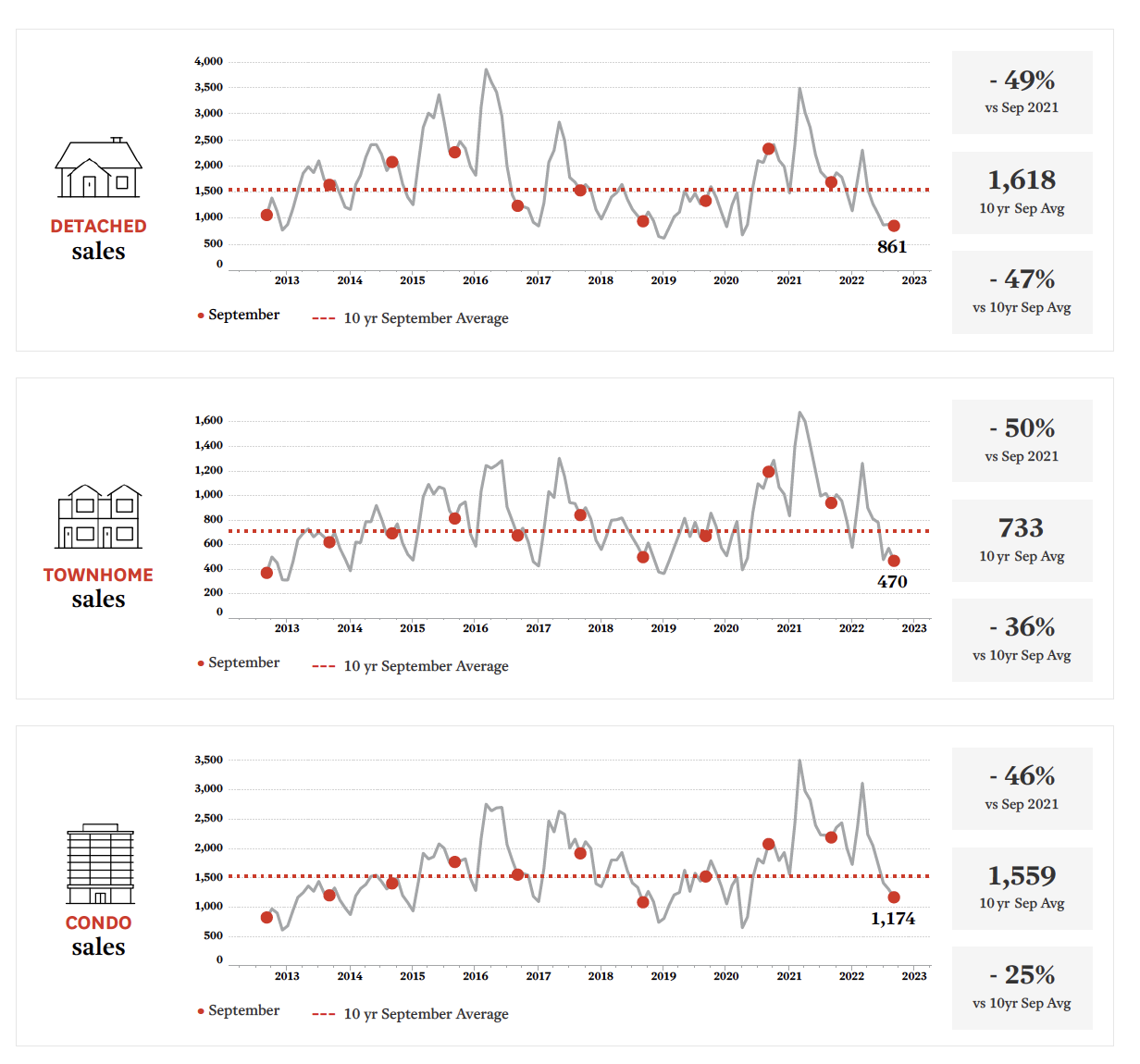

On a month-over-month basis, townhome, condo, and detached home sales fell by 18% (to 470), 10% (to 1,174), and 3% (to 861), respectively.

On a year-over-year basis, townhome, condo, and detached home sales were lower by 50%, 46%, and 49%, respectively. Compared to past-decade September averages, sales were lower by 36% for townhomes, 25% for condos, and 47% for detached homes. ListingsFor the first time since June, inventory expanded into September on a month-over-month basis— only by a hair, at 0.8%— 15,038 listings. While this is in line with the typical seasonal rise of 1.3%, last month’s inventory remains 21% below the past-decade average for September.

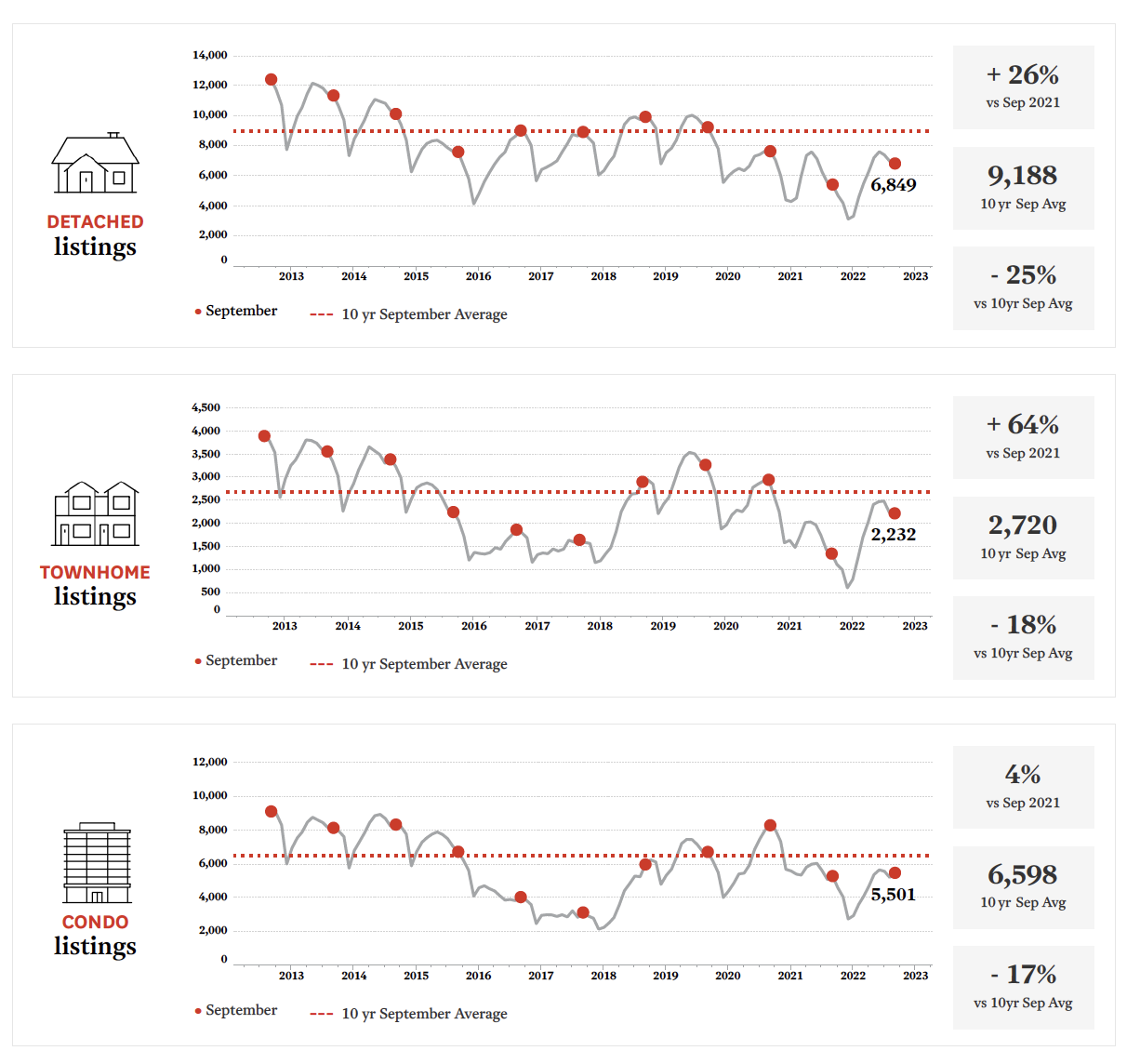

ListingsFor the first time since June, inventory expanded into September on a month-over-month basis— only by a hair, at 0.8%— 15,038 listings. While this is in line with the typical seasonal rise of 1.3%, last month’s inventory remains 21% below the past-decade average for September.

Compared to August, detached and townhome inventory fell by 2% (to 6,849 listings) and 0.9% (to 2,232), respectively; while, condo inventory rose by 5% (to 5,501). Compared to last year, inventory was up for all home types in September—by 64% for townhomes, 26% for detached homes, and 4% for condos.

There were 5.7 months of inventory (MOI) in September, reflecting balanced conditions in the Vancouver Region. That said, only the detached segment of the market was balanced (MOI of 8.0), with conditions favouring sellers continuing to characterize the townhome and condo segments (each with 4.7 MOI). Median PricesMedian sold prices for the Fraser Valley and Greater Vancouver board areas declined in September, on average (across home types), by 1.2% and 1.9% respectively, compared to August.

Median PricesMedian sold prices for the Fraser Valley and Greater Vancouver board areas declined in September, on average (across home types), by 1.2% and 1.9% respectively, compared to August.

On a month-over-month basis in the Greater Vancouver board area, median sold prices for detached homes and condos fell by 1.2% and 3%, respectively, whereas the townhome median price rose by 0.5%. In the Fraser Valley board area, median prices fell by 3% for condos, 1.5% for detached homes, and 1.3% for townhomes.

On a year-over-year basis, the Fraser Valley board area recorded median price increases of 2% for townhomes and 6% for condos, which exceeded the 2% decline for townhomes and the 2% increase for condos in the Greater Vancouver board area. The Valley’s detached home median sold price fell by 6% while in the Greater Vancouver board. Our rennie intelligence team comprises our in-house demographer, senior economist, and market analysts. Together, they empower individuals, organizations, and institutions with data-driven market insight and analysis. Experts in urban land economics, community planning, shifting demographics, and real estate trends, their strategic research supports a comprehensive advisory service offering and forms the basis of frequent reports and public presentations. Their thoughtful and objective approach truly embodies the core values of rennie.

Our rennie intelligence team comprises our in-house demographer, senior economist, and market analysts. Together, they empower individuals, organizations, and institutions with data-driven market insight and analysis. Experts in urban land economics, community planning, shifting demographics, and real estate trends, their strategic research supports a comprehensive advisory service offering and forms the basis of frequent reports and public presentations. Their thoughtful and objective approach truly embodies the core values of rennie.

Written by

Related

Sales in King County kicked off the new year on the same subdued trend as the prior year with sales well-below their long-run monthly average.

Feb 2025

Report

Sales in the Vancouver Region in January were down marginally relative to the prior year, ending three consecutive months of large year-over-year sales gains. In contrast, new listings activity was up sharply to start the year with more new homes coming to market than any January over the prior two decades.

Feb 2025

Report