📉 Overall Market Trends

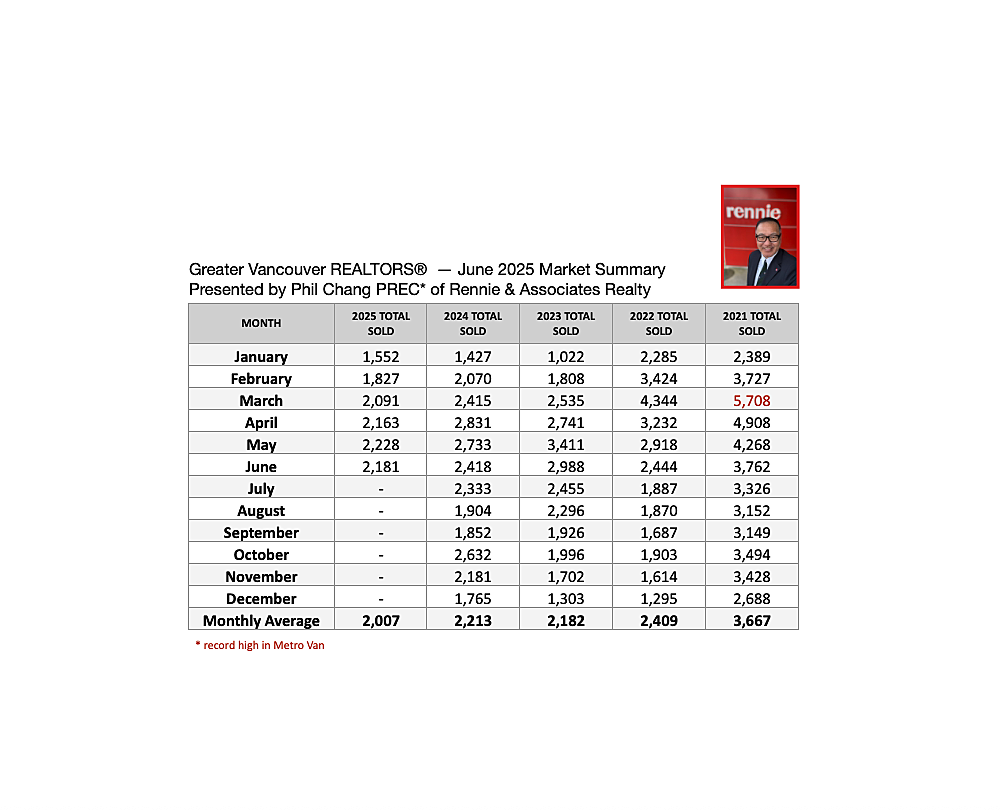

- Sales: 2,181 homes sold in June 2025 — down 9.8% YoY (from 2,418 in June 2024)

- 25.8% below the 10-year June average (2,940 sales)

- Sales decline halved compared to May — early signs of stabilization

- New listings: 6,315 in June — up 10.3% YoY, and 12.7% above10-year average

- Total active listings: 17,561 — up 23.8% YoY and 43.7% above10-year average

📊 Sales-to-Active Listings Ratio (June 2025)

Overall: 12.8%

- Detached homes: 9.9%

- Townhomes (Attached): 16.9%

- Apartments: 13.9%

Ratios:

- <12%→ Downward price pressure; >20%→ Upward price pressure

💵 Benchmark Home Prices (June 2025)

All property types: $1,173,100 (↓ 2.8% YoY | ↓ 0.3% MoM)

By property type:

Detached homes:

- Sales: 657 (↓ 5.3% YoY)

- Price: $1,994,500 (↓ 3.2% YoY | ↓ 0.1% MoM)

Apartments:

- Sales: 1,040 (↓ 16.5% YoY)

- Price: $748,400 (↓ 3.2% YoY | ↓ 1.2% MoM)

Attached/Townhomes:

- Sales: 473 (↑ 3.7% YoY)

- Price: $1,103,900 (↓ 3.0% YoY | ↓ 0.3% MoM)

🏙️ Regional Highlights – June 2025 Benchmark Prices (Selected Areas)

Greater Vancouver composite:

* $1,173,100 → ↓ 2.8% YoY | ↓ 0.4% MoM

Detached Homes:

- Vancouver West: $3,399,000

- Vancouver East: $1,831,800

- Burnaby North: $2,131,900

- Coquitlam: $1,750,600

- Maple Ridge: $1,282,700

- North Vancouver: $1,352,100

- Coquitlam: $1,096,600

- Burnaby South: $1,075,70

Apartments:

- Vancouver West: $824,500

- North Vancouver: $817,600

- New Westminster: $637,800

- Maple Ridge: $514,600

📈 Other Market Insights

- Buyers benefiting from higher inventory and lower mortgage rates (~2% down YoY)

- Detached and apartment prices trending slightly downward

- Attached segment shows relative resilience in pricing and sales