Benchmark Prices - March 2019

Mar 11, 2019

Written by

Ryan BerlinSHARE THIS

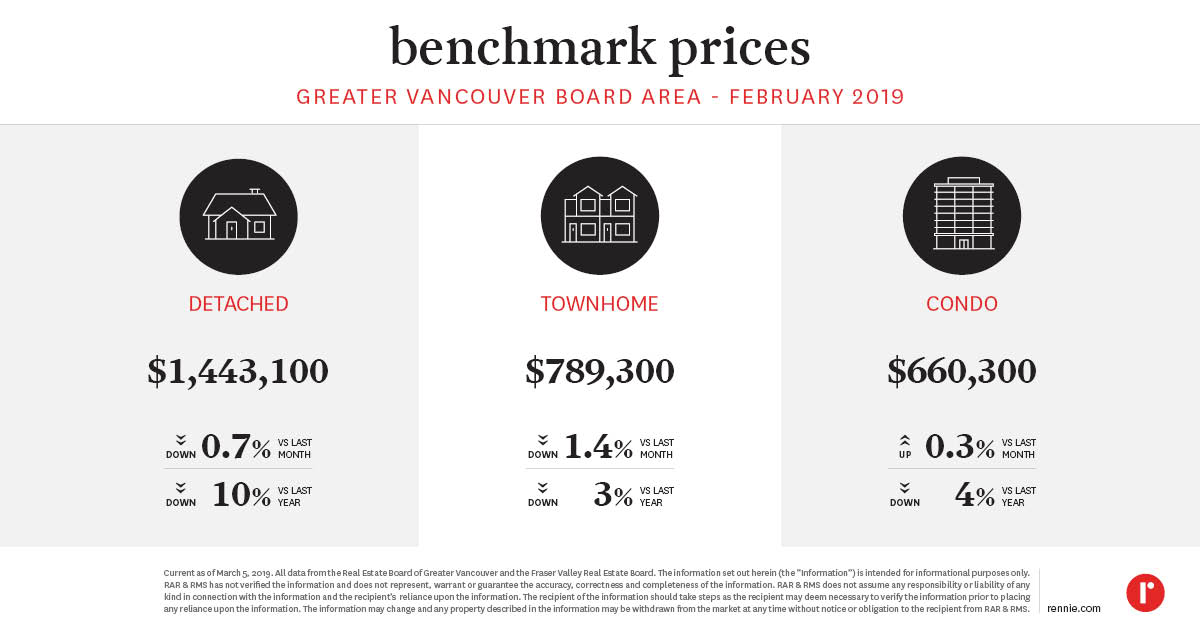

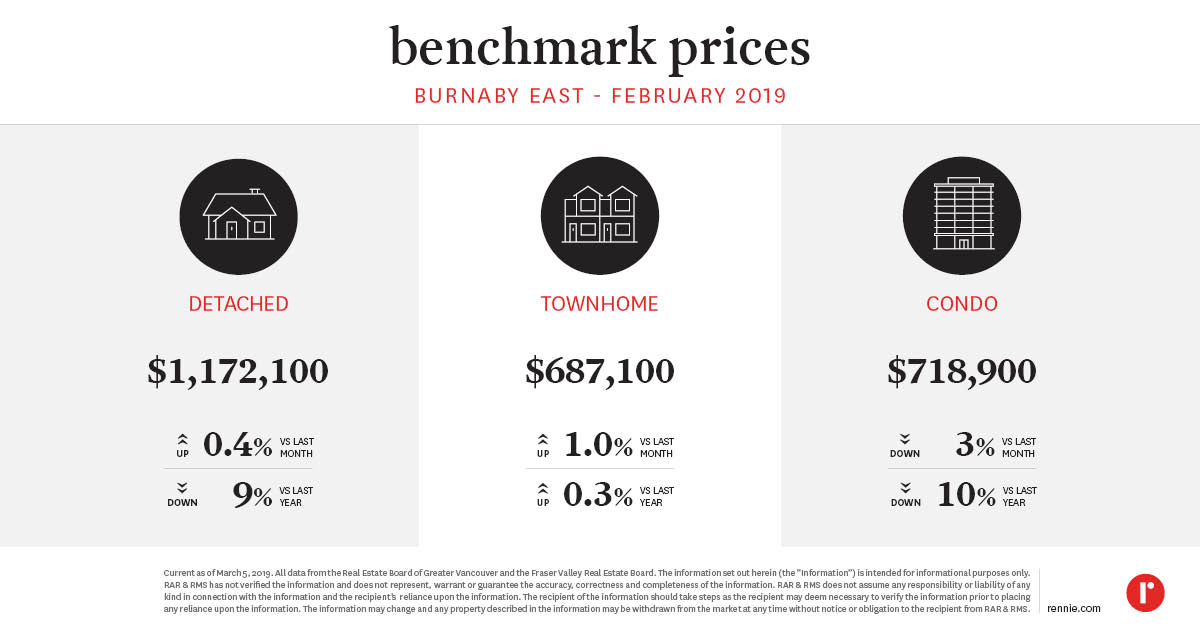

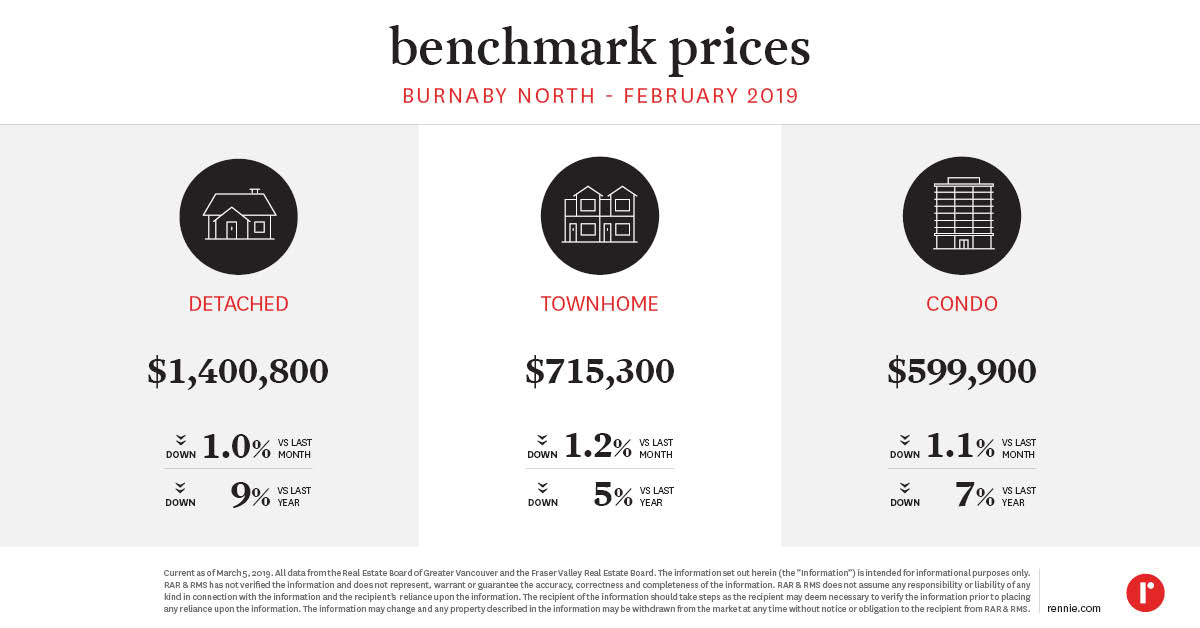

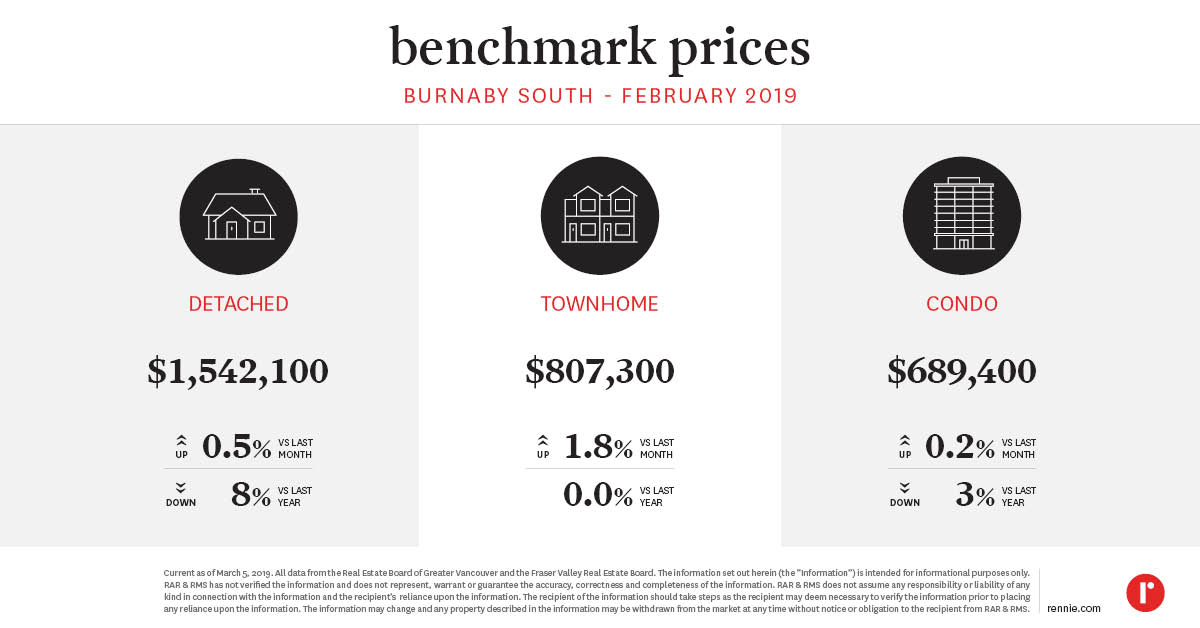

Here are the Benchmark Price Infographics for the areas of the Lower Mainland covered in the monthly rennie review. The areas include the REBGV, Burnaby East, Burnaby North, Burnaby South, Coquitlam, North Vancouver, Richmond, Vancouver East, Vancouver West, West Vancouver, New Westminster, Squamish, Tsawwassen, Port Coquitlam, Port Moody, FVREB, Surrey, Langley, Pitt Meadows, Maple Ridge, White Rock, Abbotsford, and CADREB.Greater Vancouver Board Area Burnaby East

Burnaby East Burnaby North

Burnaby North Burnaby South

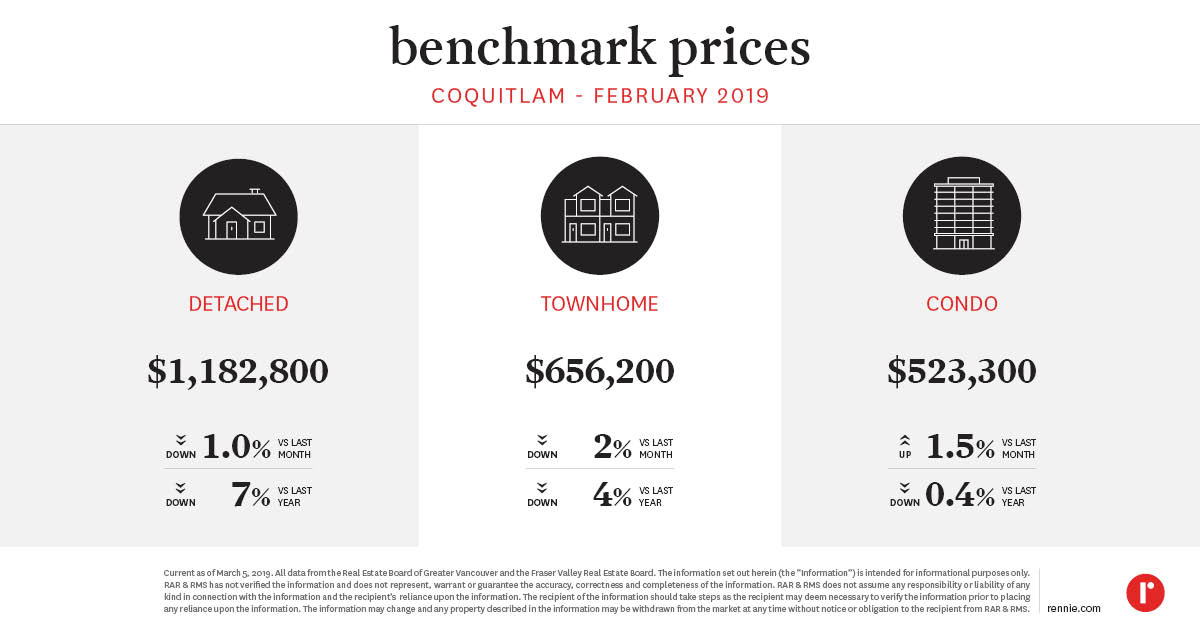

Burnaby South Coquitlam

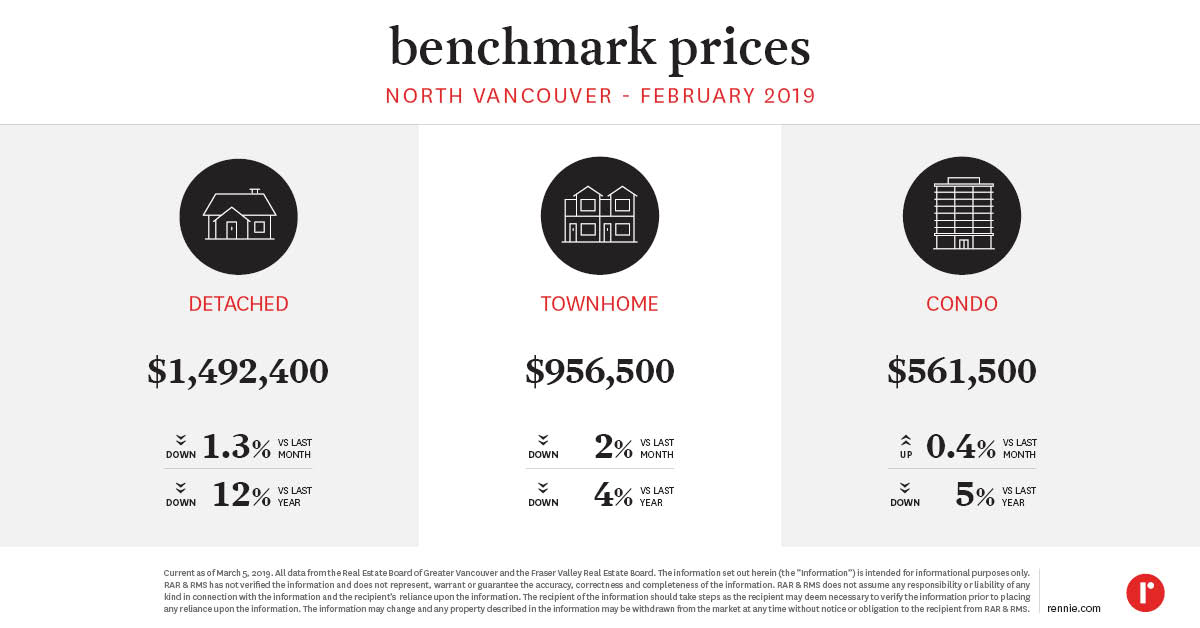

Coquitlam North Vancouver

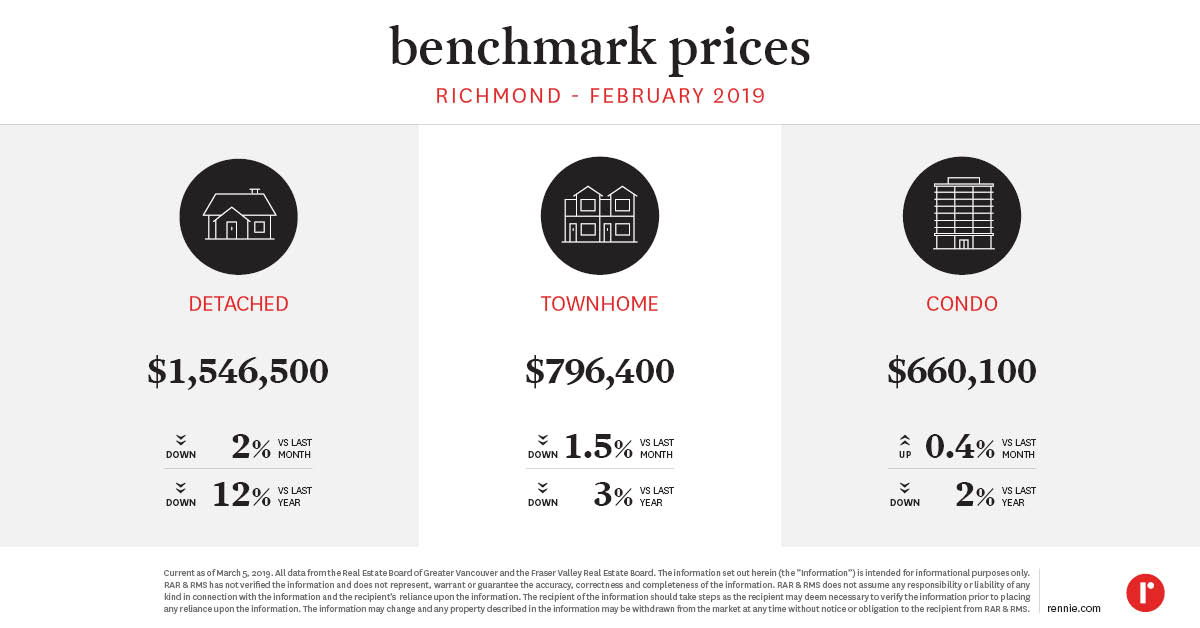

North Vancouver Richmond

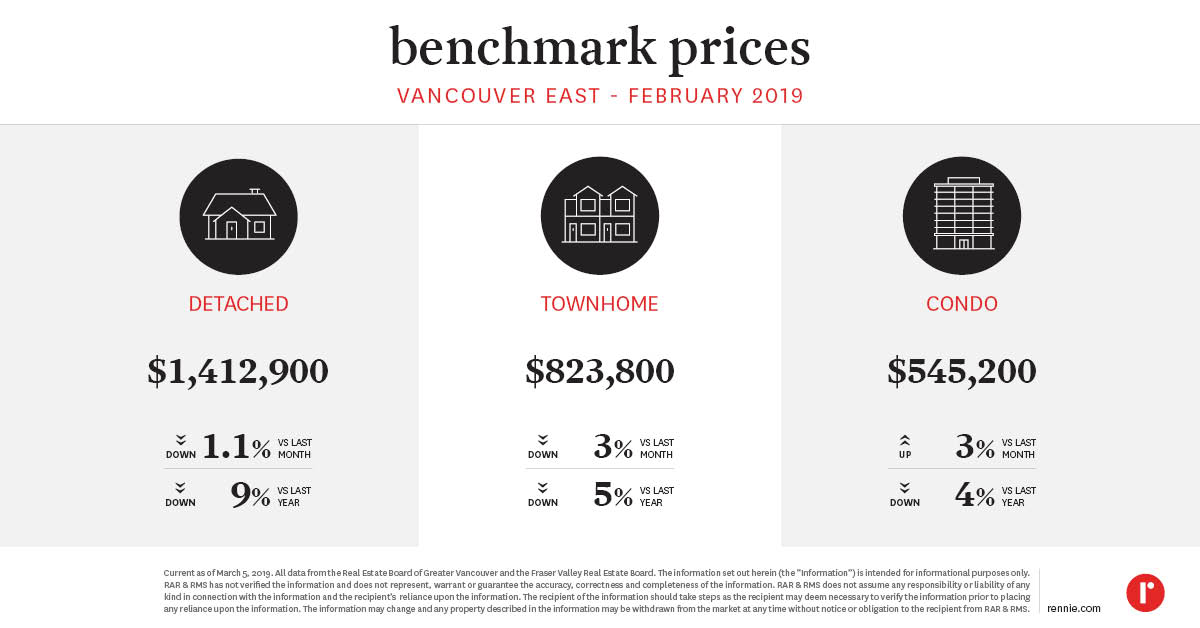

Richmond Vancouver East

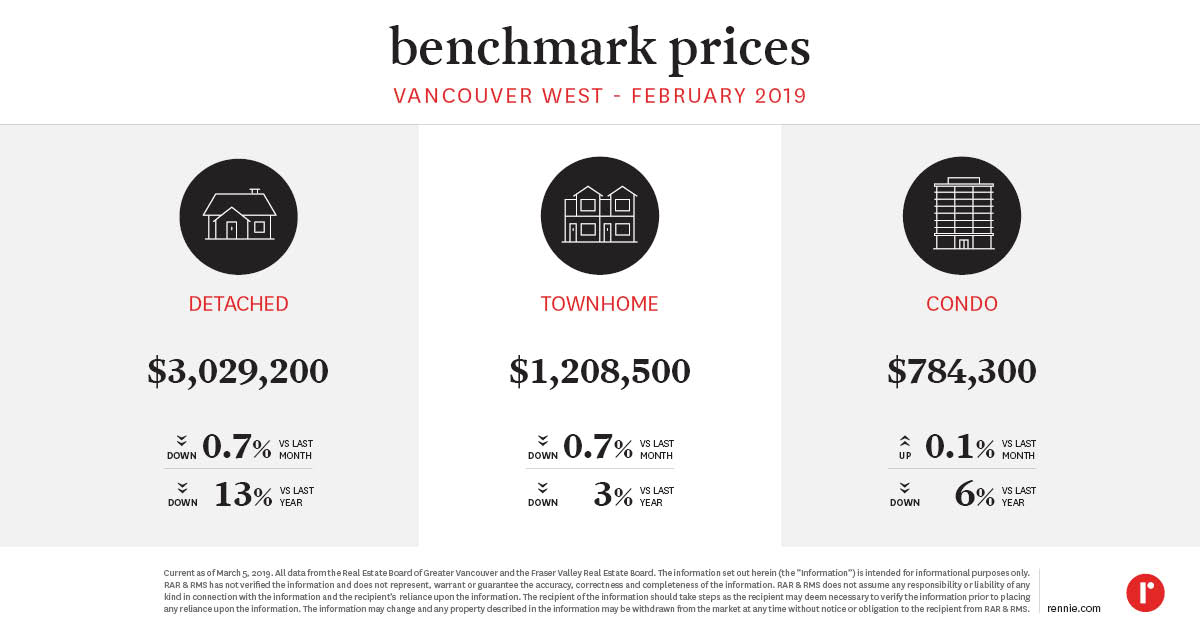

Vancouver East Vancouver West

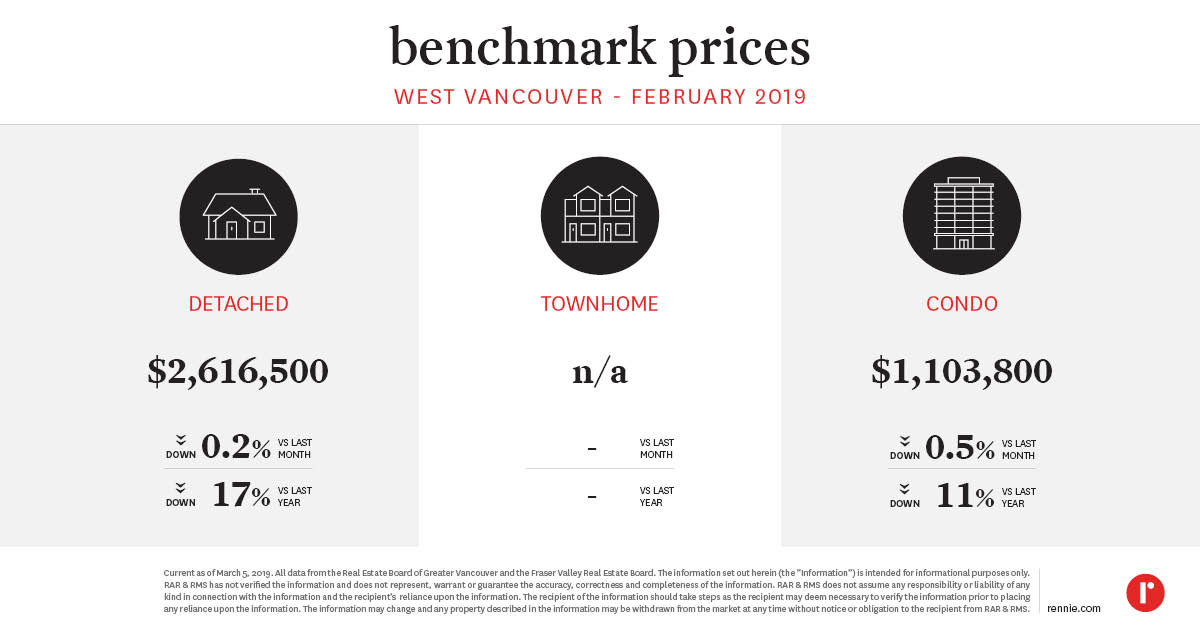

Vancouver West West Vancouver

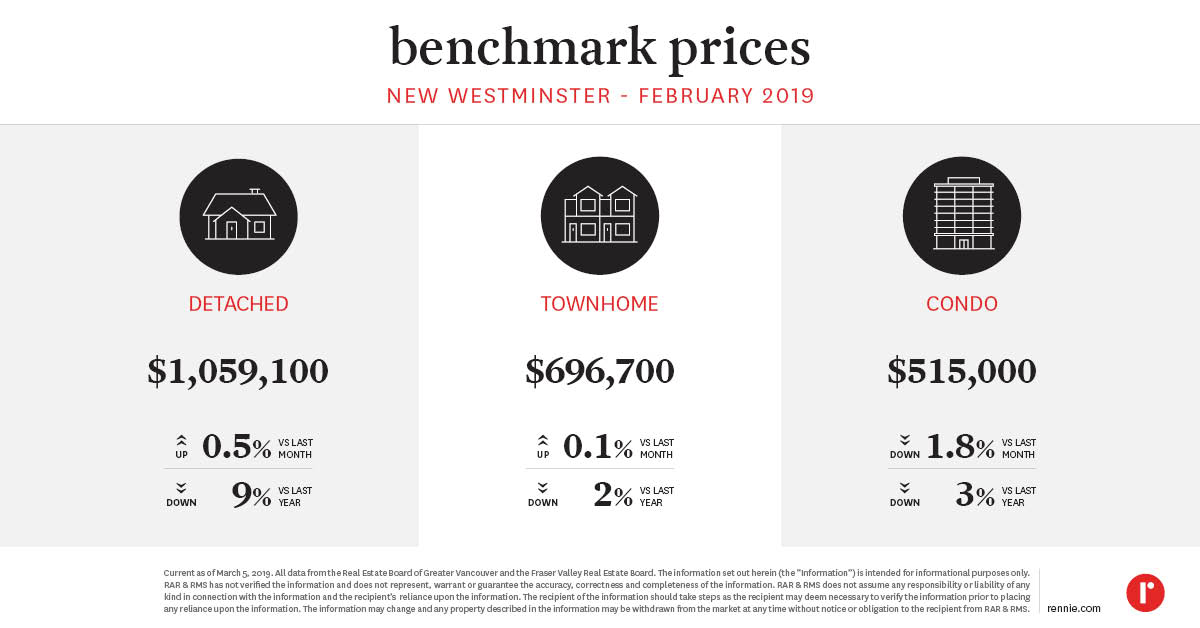

West Vancouver New Westminster

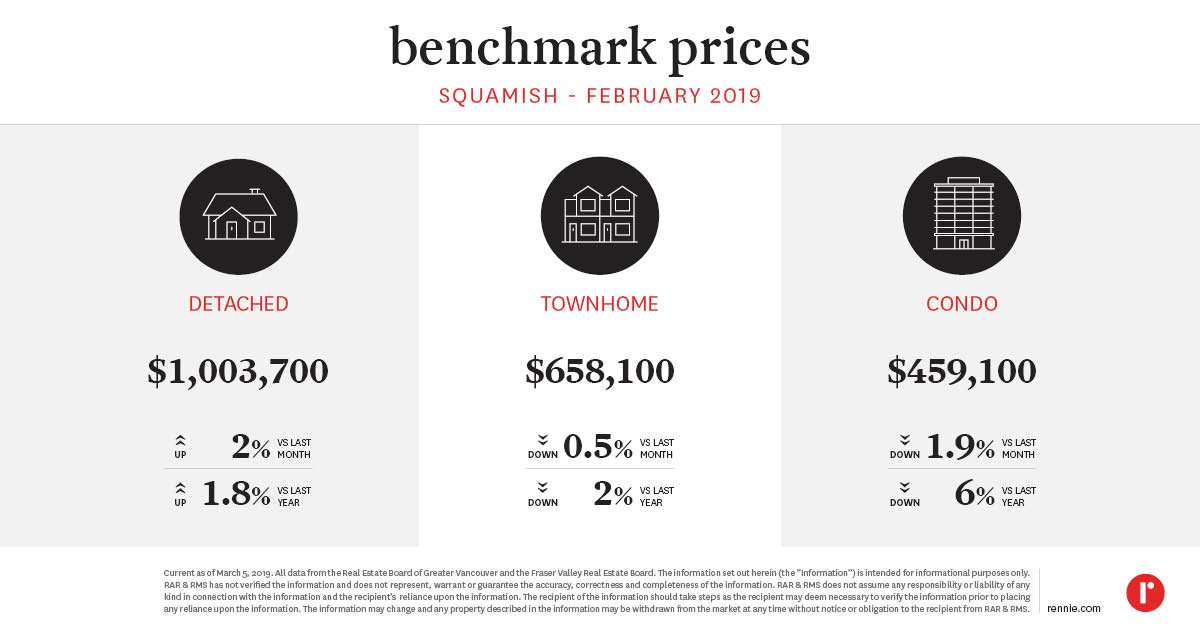

New Westminster Squamish

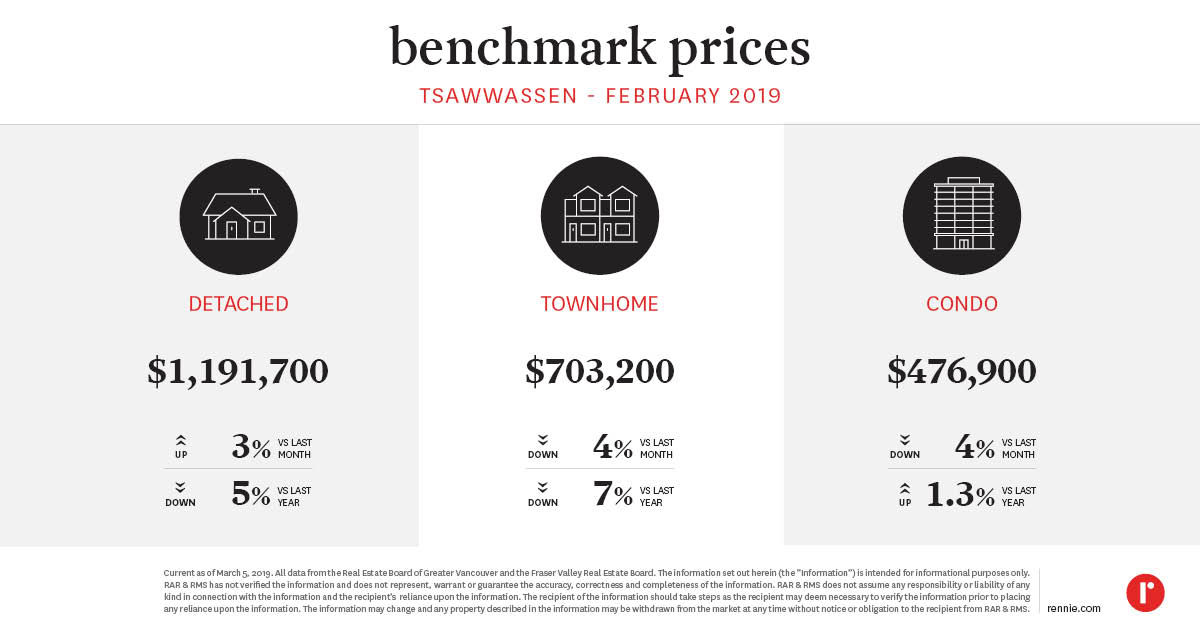

Squamish Tsawwassen

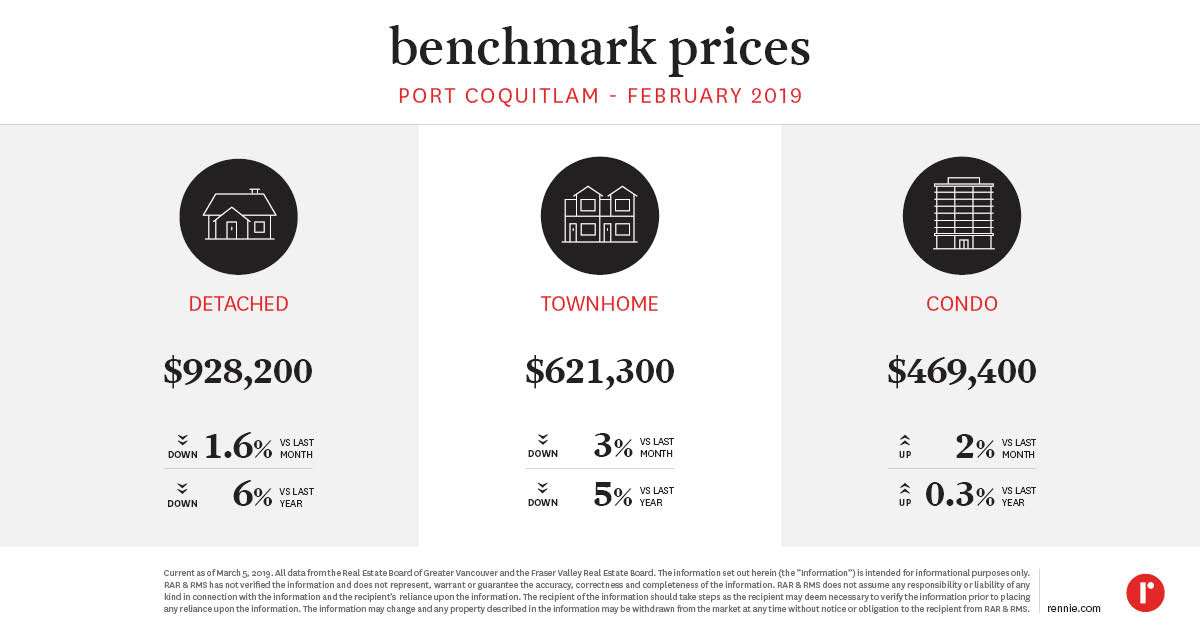

Tsawwassen Port Coquitlam

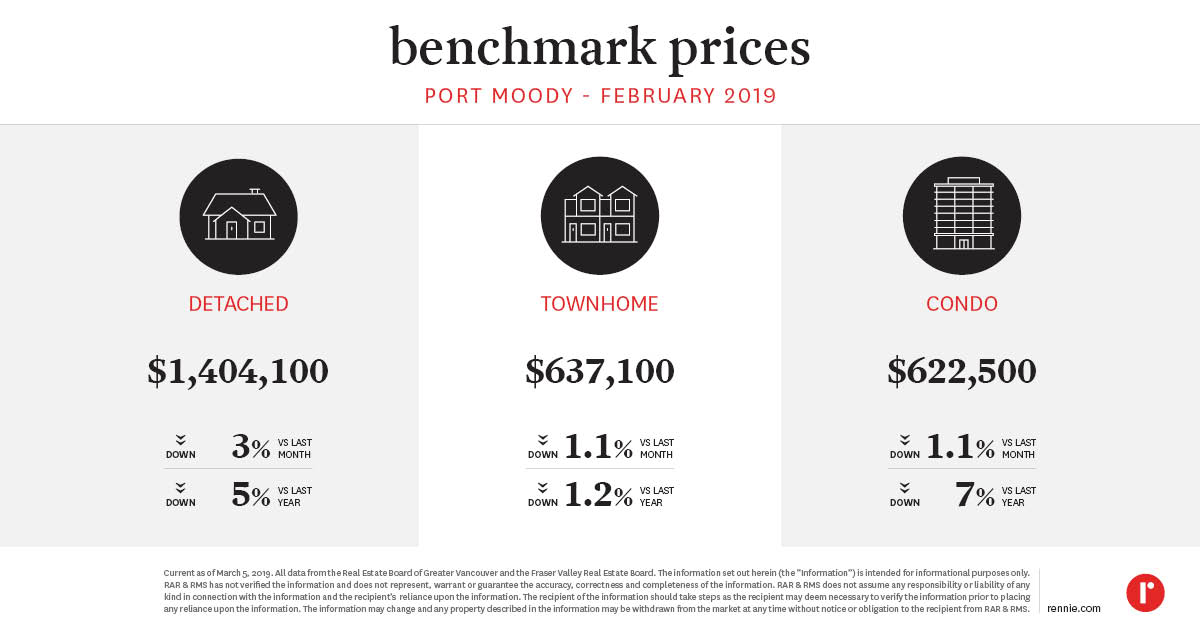

Port Coquitlam Port Moody

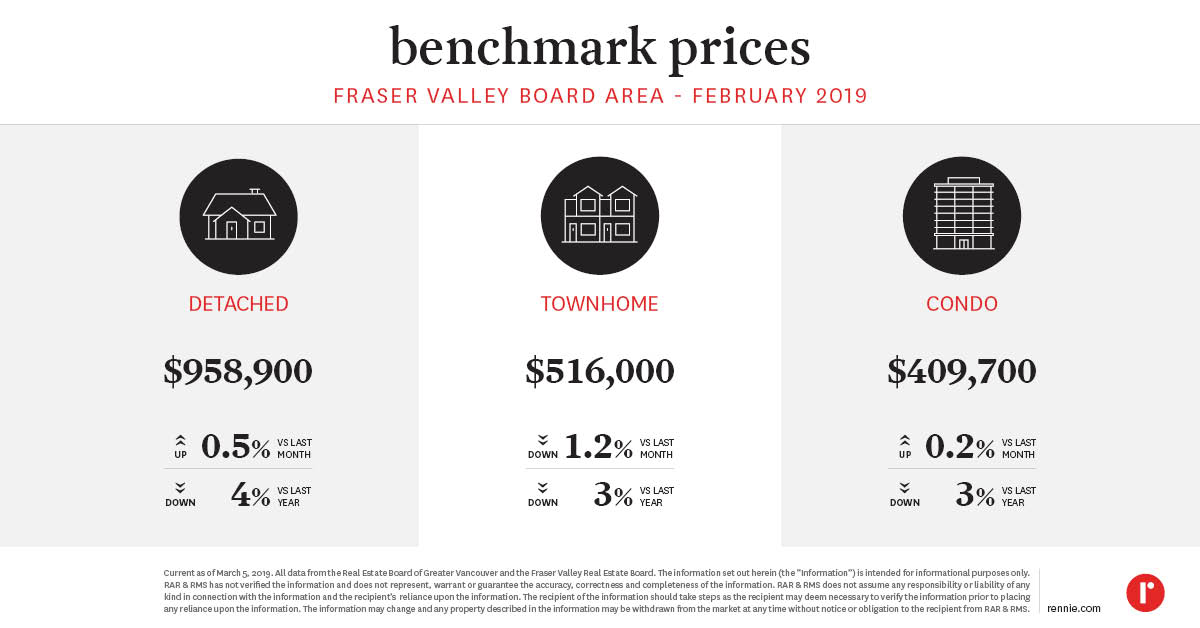

Port Moody Fraser Valley Board Area

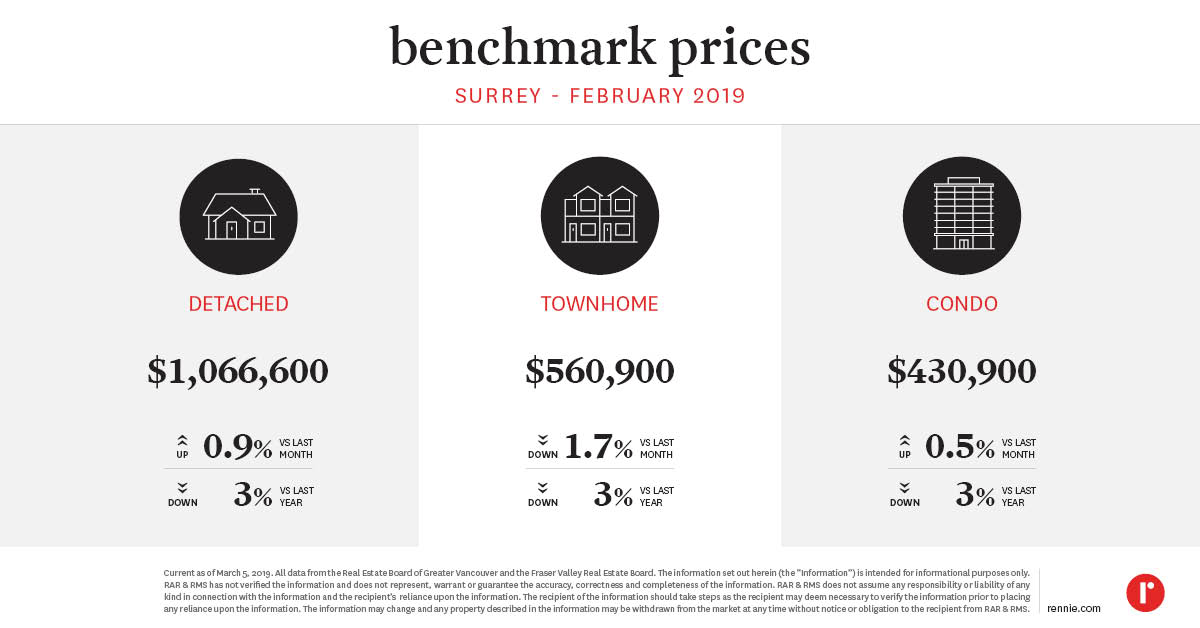

Fraser Valley Board Area Surrey

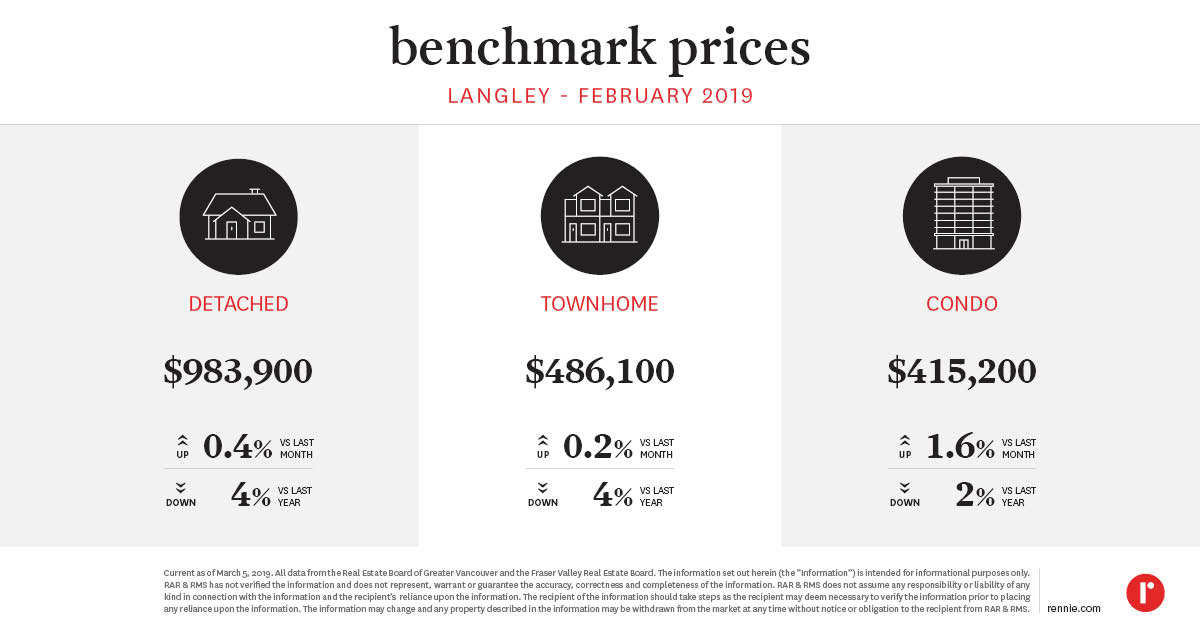

Surrey Langley

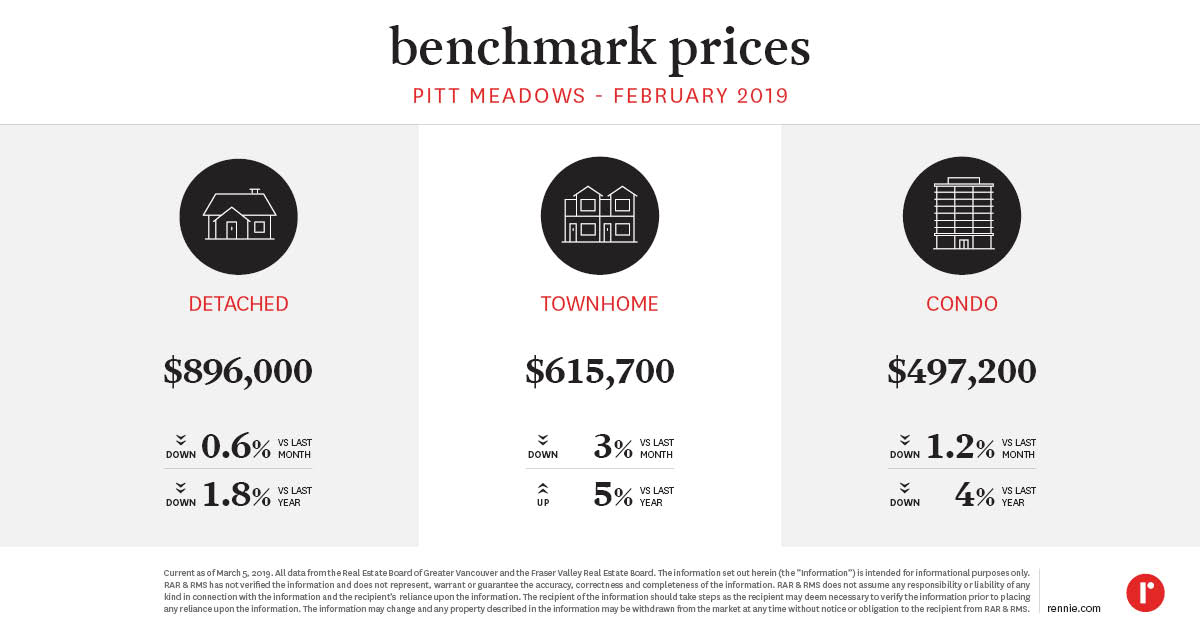

Langley Pitt Meadows

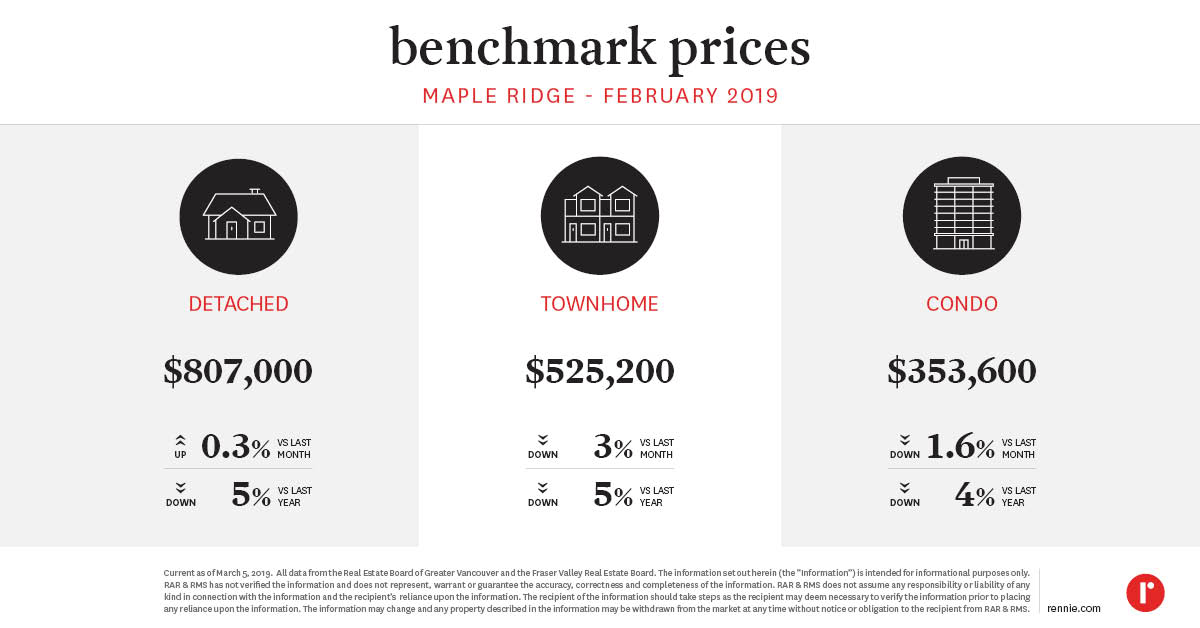

Pitt Meadows Maple Ridge

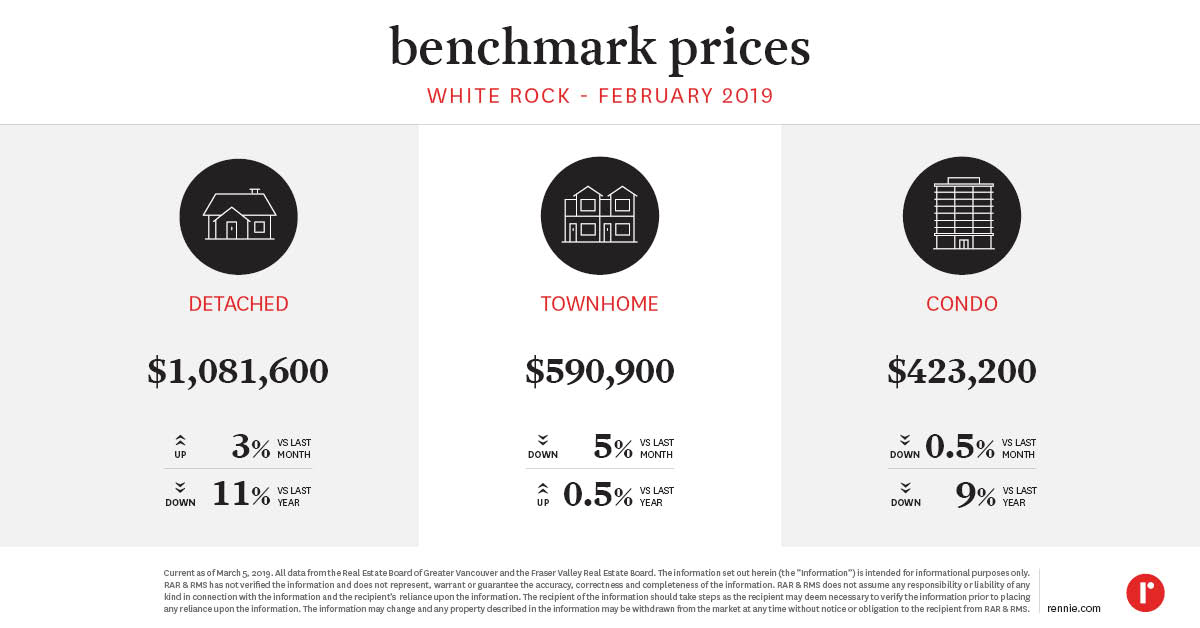

Maple Ridge White Rock

White Rock Abbotsford

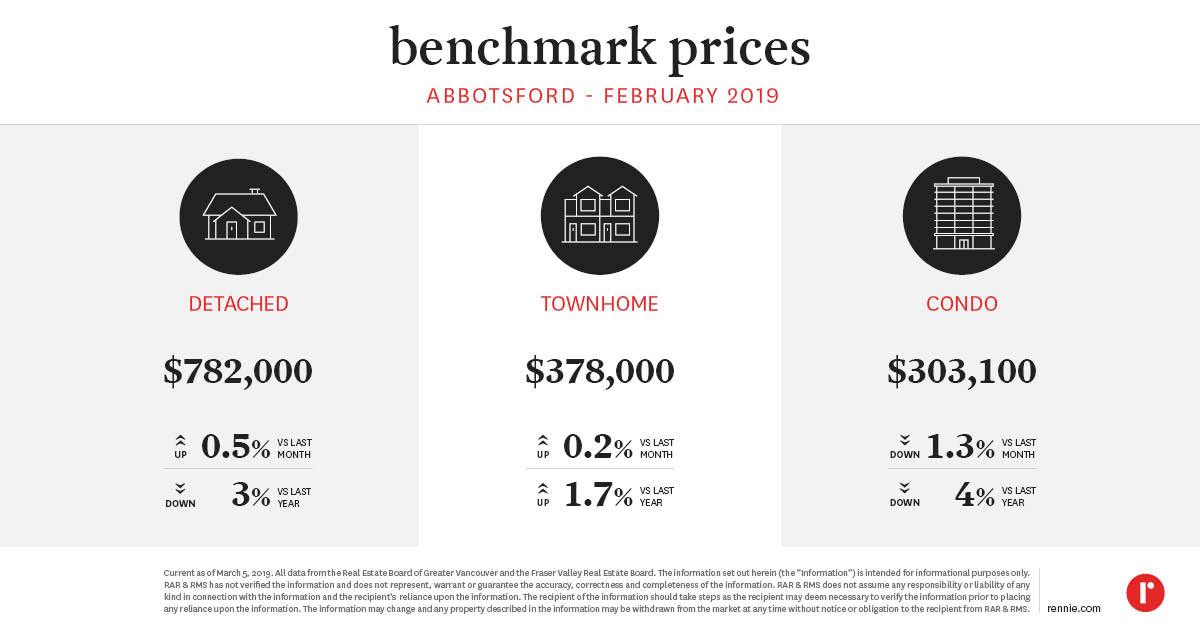

Abbotsford Chilliwack and District Board Area

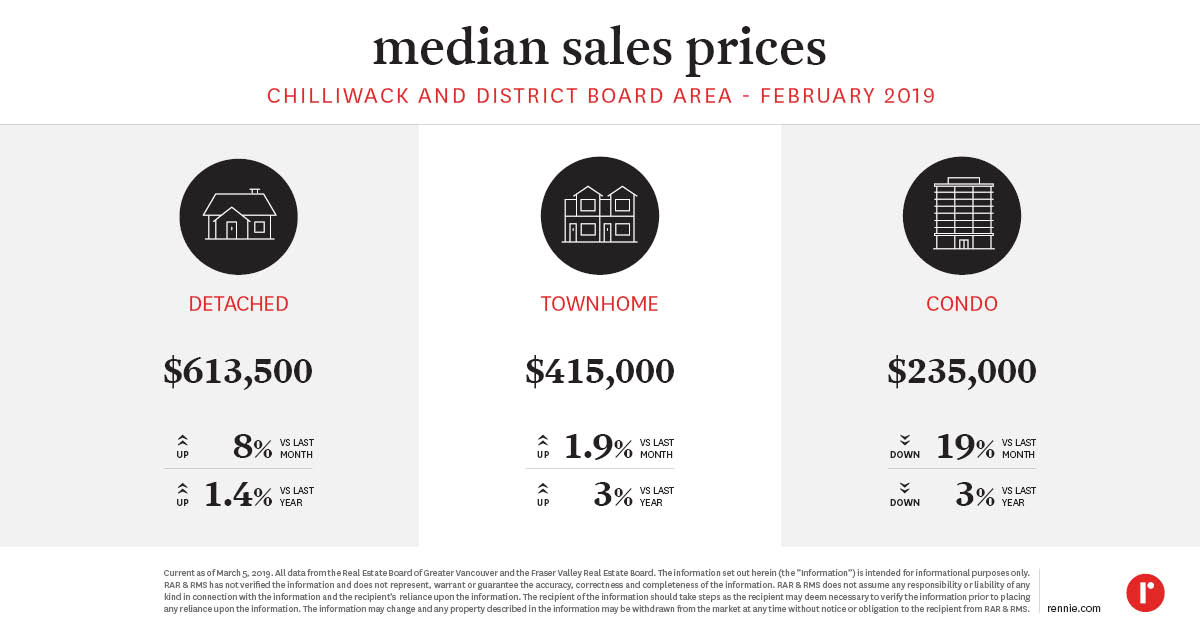

Chilliwack and District Board Area Note, the Chilliwack and District Board Area (CADREB) denotes the Median Sales Price rather than the Benchmark Price. The CADREB does not have a benchmark price available for record.

Note, the Chilliwack and District Board Area (CADREB) denotes the Median Sales Price rather than the Benchmark Price. The CADREB does not have a benchmark price available for record.

See Benchmark Prices Infographics for February 2019 here. Our rennie intelligence division empowers individuals, organizations, and institutions with data-driven market insight and analysis. Experts in urban land economics, community planning, shifting demographics, and real estate trends, their strategic research supports a comprehensive advisory service offering and forms the basis of frequent reports and public presentations. Their thoughtful and objective approach truly embodies the core values of rennie.

Written by

Related

Over the course of 2025, the Coachella Valley housing market posted a moderate gain in total sales relative to 2024. Nonetheless, the two years ranked as the slowest for sale counts in the past decade. Inventory similarly increased moderately over the year, but remained meaningfully below long-run norms.

Jan 2026

Report

Annual sales in Greater Victoria were trending toward a small year-over-year gain through the first 11 months of 2025, but a slower December resulted in a small decline. Last year registered the most new listings since 2011, and inventory closed the year at the highest level since 2014.

Jan 2026

Report