Rental Housing and Our Lack of Purpose (Built)

Oct 19, 2022

Written by

Ryan BerlinSHARE THIS

While all of us agree we need to expand our stock of rental housing here in Metro Vancouver, the burden to do so is being shouldered unevenly across the primary and secondary segments. In the most recent edition of our rennie landscape publication, we took a look at how the rental apartment stock has been changing in Metro Vancouver. Here, we’re re-sharing some of those insights and including some new ones on the longer-term trend in purpose-built rental housing in the region.

The supply of rental housing comes in many forms, from purpose-built apartment buildings to individually-owned homes to basement suites. Together, these forms of accommodation represent an important segment of our dwelling stock, providing an alternative to ownership, allowing for flexibility in mobility, requiring lower payments, and representing the first step for many onto the housing market ladder.

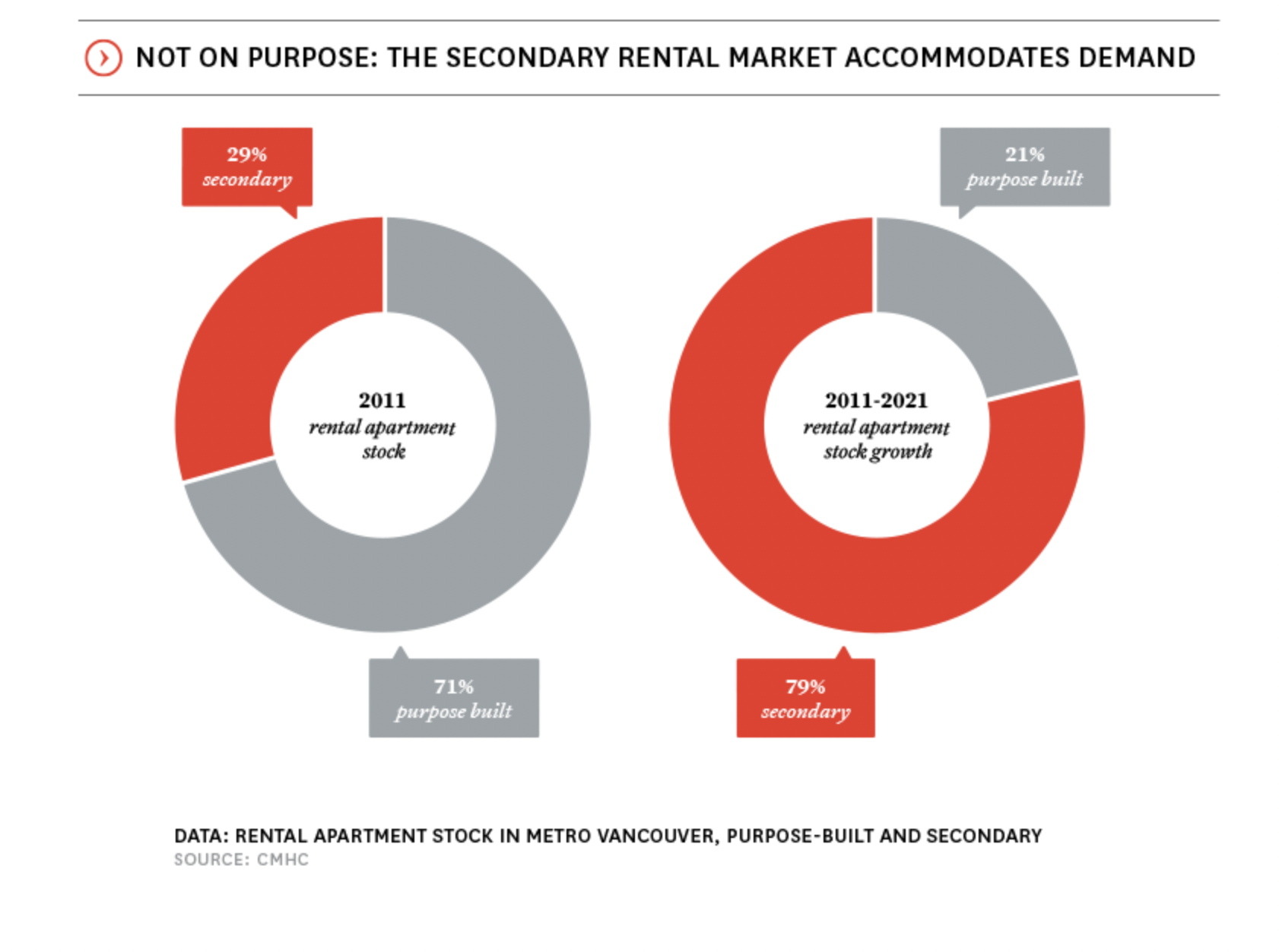

The purpose-built segment of our rental market, as far as apartments are concerned, accounts for the largest proportion of homes of this tenure in Metro Vancouver, at 59%, with the remaining 41% existing with the secondary market (that is, as individually-owned condos). Notably, this split in burden between the primary (purpose-built) and secondary markets has shifted considerably over the past decade, with the secondary market accounting for almost 4 out of every 5 net additional rental homes available. This is part of a much longer-term trend that has seen the number of purpose-built rental apartments in Metro Vancouver grow, but at a much slower rate than the population as a whole. To wit, between 2001 and 2021, the region’s stock of purpose-built rental apartments grew from 107,000 to 115,000, with the 8,000 net additions representing growth of about 8%. In comparison—and a crude comparison it is, as we’re not accounting for changes in age composition or incomes, two features of the underlying population that influence rental housing demand—the region’s population expanded by 700,000 people and 34% over the same period.

This is part of a much longer-term trend that has seen the number of purpose-built rental apartments in Metro Vancouver grow, but at a much slower rate than the population as a whole. To wit, between 2001 and 2021, the region’s stock of purpose-built rental apartments grew from 107,000 to 115,000, with the 8,000 net additions representing growth of about 8%. In comparison—and a crude comparison it is, as we’re not accounting for changes in age composition or incomes, two features of the underlying population that influence rental housing demand—the region’s population expanded by 700,000 people and 34% over the same period.

In bringing these two metrics together, the number of purpose-built rental homes per 1,000 residents in Metro Vancouver fell by 20% over the past 20 years, going from 51.4 to 41.4 most recently. Among major metros across Canada, this current per-capita ratio is second-lowest, ahead of only Calgary’s 28.7 (Montreal leads the way at 141.1—up 11% compared to 2001, and the only major metro region to see its ratio increase over the period).

It’s been said that today’s new purpose-built rental housing is tomorrow’s affordable rental housing; indeed, if we don’t continue to add rental housing in Metro Vancouver—which could grow by upwards of 60,000 people annually over the next few years, and with the majority of in-movers choosing to rent—the regional vacancy rate of 1.2% is unlikely to get better. And along with that, of course, comes upward pressure on monthly rents. With features such as professional management, enhanced amenities, and security of tenure—characteristics that are more closely associated with buildings in the primary rental segment as opposed to the secondary one—the expansion of our purpose-built rental stock is critical.Our rennie intelligence team comprises our in-house demographer, senior economist, and market analysts. Together, they empower individuals, organizations, and institutions with data-driven market insight and analysis. Experts in urban land economics, community planning, shifting demographics, and real estate trends, their strategic research supports a comprehensive advisory service offering and forms the basis of frequent reports and public presentations. Their thoughtful and objective approach truly embodies the core values of rennie.

Written by

Related

Our annual compendium of housing, demographic, and economic predictions for the year ahead. Read now >

Feb 2026

Report

Recent tech layoffs have impacted Seattle, pushing the local unemployment rate above the national.

Feb 2026

Article

5mins read