the rennie advance - November 2022

Nov 01, 2022

Written by

Ryan BerlinSHARE THIS

Home buyers remained relatively scarce in October, with the Vancouver Region having now tallied 4 straight months of sub-3,000 sales for the first time since early-2019. Meanwhile, a strong labour market, elevated listing cancellations, and subdued new listing activity have kept a lid on inventory, with balanced conditions prevailing overall.SalesTotal MLS sales in the Vancouver Region in October (2,778) failed to reach the 3,000 mark for the fourth straight month, the first time this has been observed since early 2019 (not even during the depths of the pandemic did sales counts come in so consistently low). Compared to a very active October 2021, last month’s sales were down 48%, while sitting 36% below the past-decade October average.

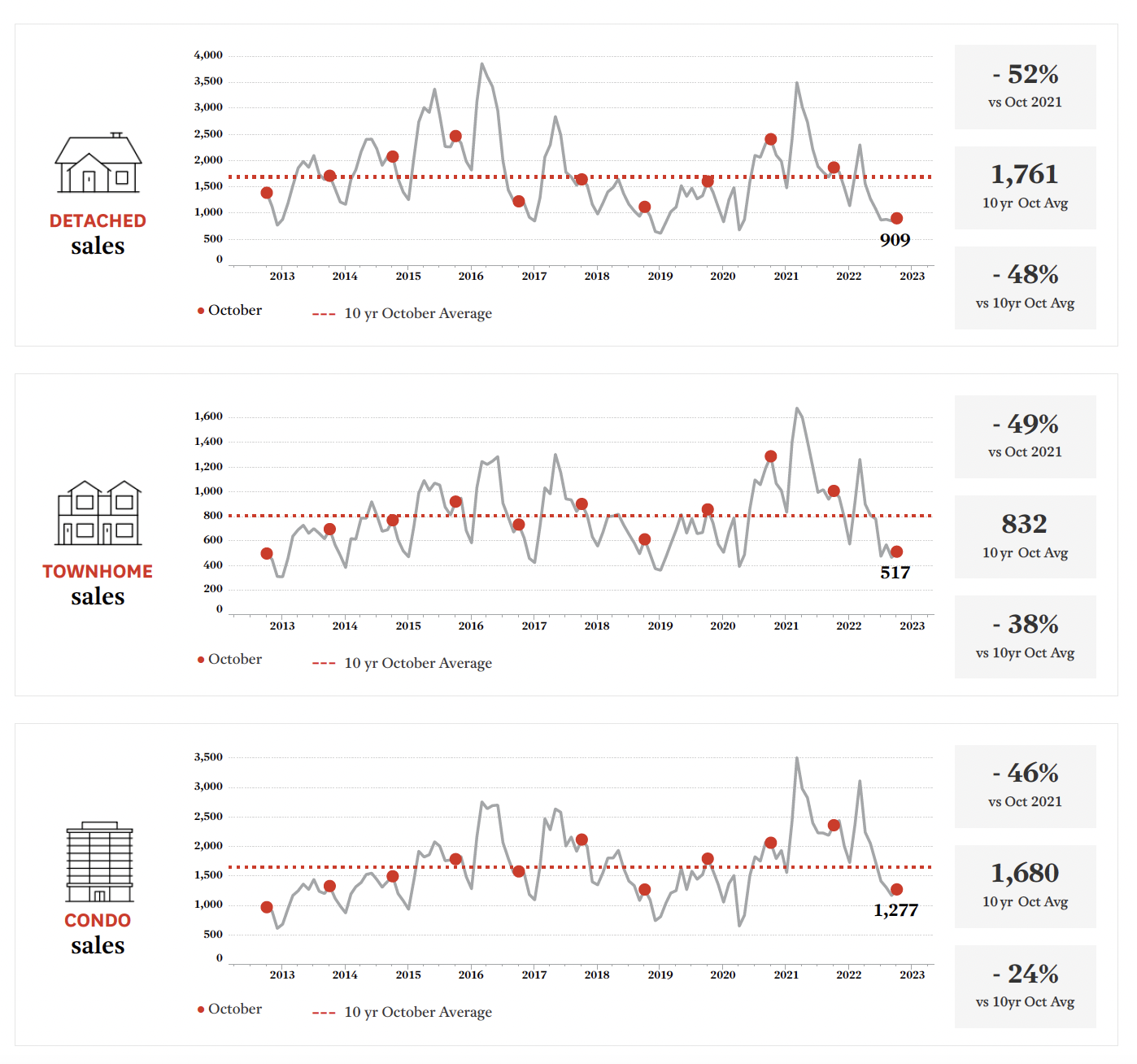

On a month-over-month basis, sales were up 9% (exactly in line with the typical September-to-October change), with townhome, condo, and detached home sales up 10% (to 517), 9% (to 1,277), and 6% (to 909), respectively.

Compared to October 2021, last month’s townhome sales were 49% lower, condo sales were 46% lower, and detached home sales were 52% lower. ListingsDue to a strong labour market, elevated listing cancellations, and sagging new listings, the region’s inventory of homes for sale fell to 14,661 in October (down 3% vs September, compared to a 5% typical seasonal drop). While inventory remains elevated compared to last year (by 36%), it is best characterized as constrained, sitting at 18% below the past 10-year October average.

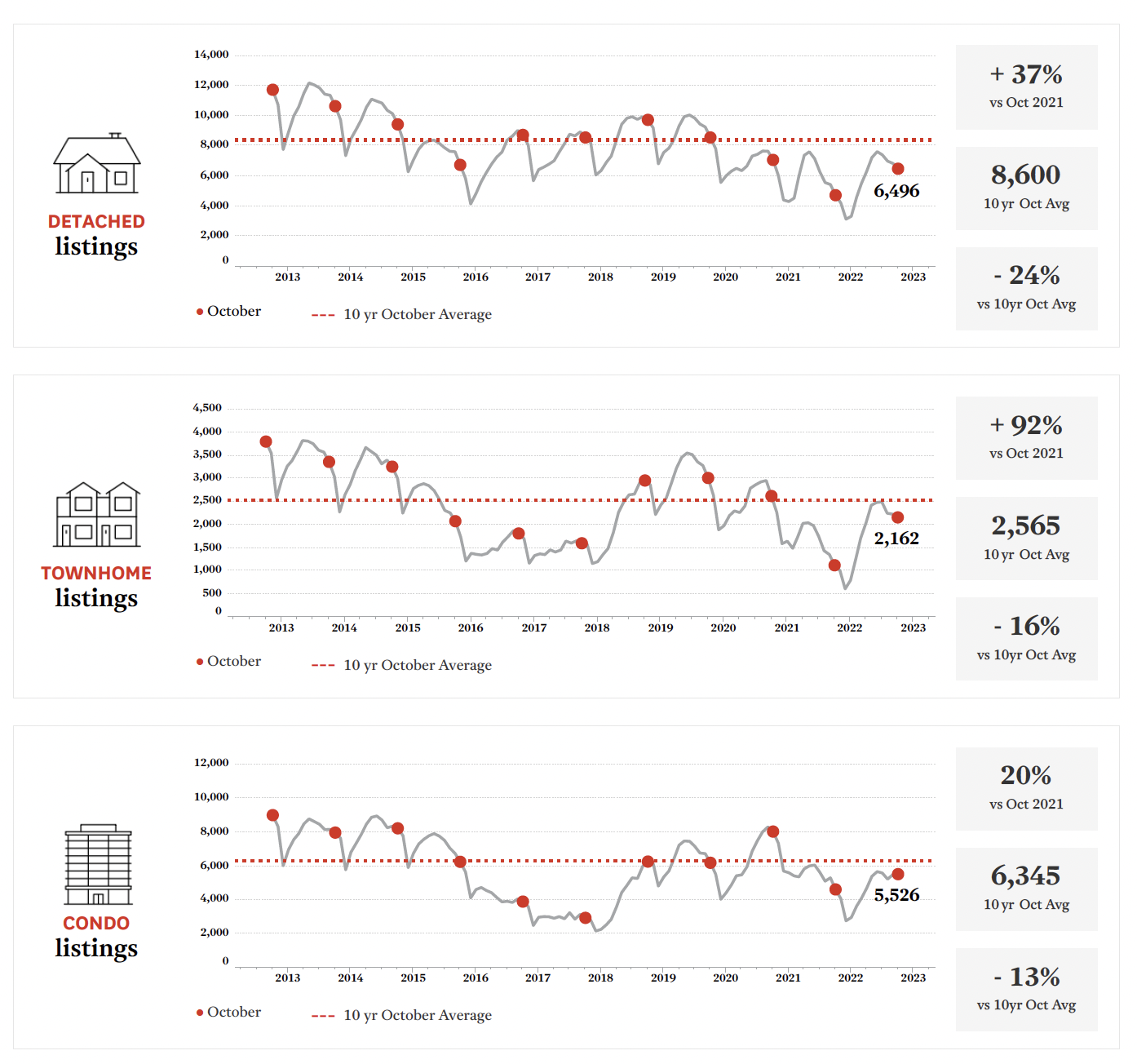

ListingsDue to a strong labour market, elevated listing cancellations, and sagging new listings, the region’s inventory of homes for sale fell to 14,661 in October (down 3% vs September, compared to a 5% typical seasonal drop). While inventory remains elevated compared to last year (by 36%), it is best characterized as constrained, sitting at 18% below the past 10-year October average.

On a month-over-month basis, detached home listings (6,496) and townhome listings (2,162) fell by 5% and 3%, respectively. In contrast, condo listings rose marginally (by 0.5%) to 5,526. Compared to October 2021, last month’s townhome listings were higher by 92%, followed by detached homes (up 37%) and condos (up 20%).

The region had 5.3 months of inventory (MOI) in October, indicating overall balanced conditions. That said, only the detached segment of the market was, in fact, balanced (7.1 MOI). Conditions continued to favour sellers in both the townhome (4.2 MOI) and condo segments (4.3 MOI). Median PricesInterestingly, October’s median sold price in the Greater Vancouver board area rose by 4%, on average across home types, compared to September, though it fell by an average of 0.1% in the Fraser Valley board area.

Median PricesInterestingly, October’s median sold price in the Greater Vancouver board area rose by 4%, on average across home types, compared to September, though it fell by an average of 0.1% in the Fraser Valley board area.

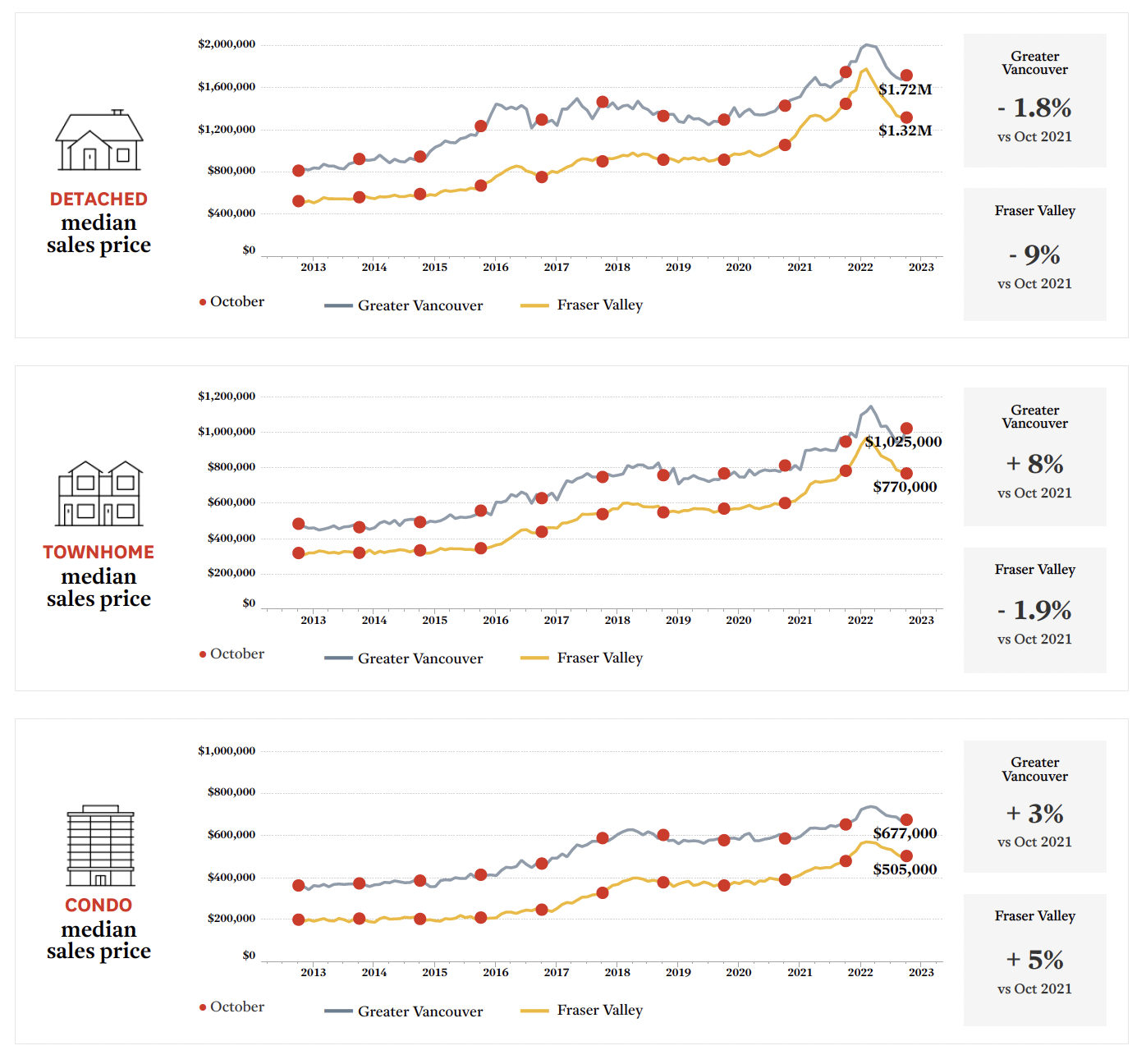

Compared to September, the median detached sold price rose by 2% in Greater Vancouver, while remaining unchanged in the Fraser Valley. The median sold price for townhomes was up by 8% in Greater Vancouver, but fell by 1.3% in the Fraser Valley, while the median condo sold price ticked up by 1.0% in both board areas.

Compared to October 2021, last month’s median detached home sold price was 1.8% and 9% lower in Greater Vancouver and the Fraser Valley, respectively. For townhomes, the price was higher by 8% in Greater Vancouver, but lower by 1.9% in the Fraser Valley. The median condo sold price was up in both areas— by 3% in Greater Vancouver and by 5% in the Fraser Valley. Our rennie intelligence team comprises our in-house demographer, senior economist, and market analysts. Together, they empower individuals, organizations, and institutions with data-driven market insight and analysis. Experts in urban land economics, community planning, shifting demographics, and real estate trends, their strategic research supports a comprehensive advisory service offering and forms the basis of frequent reports and public presentations. Their thoughtful and objective approach truly embodies the core values of rennie.

Our rennie intelligence team comprises our in-house demographer, senior economist, and market analysts. Together, they empower individuals, organizations, and institutions with data-driven market insight and analysis. Experts in urban land economics, community planning, shifting demographics, and real estate trends, their strategic research supports a comprehensive advisory service offering and forms the basis of frequent reports and public presentations. Their thoughtful and objective approach truly embodies the core values of rennie.

Written by

Related

The Central Okanagan was the only major market in BC to register a year-over-year increase in sales in February, posting its most active February in 4 years. Though inventory remains substantially higher than long-run average levels, there were fewer active listings at the end of the month when compared to the previous February.

Today

Report

The Desert experienced its largest January-to-February increase in sales in at least a decade, resulting in the highest sales count for any February since 2022. Alongside subdued new listings activity, inventory levels retreated even further below average.

Mar 2026

Report