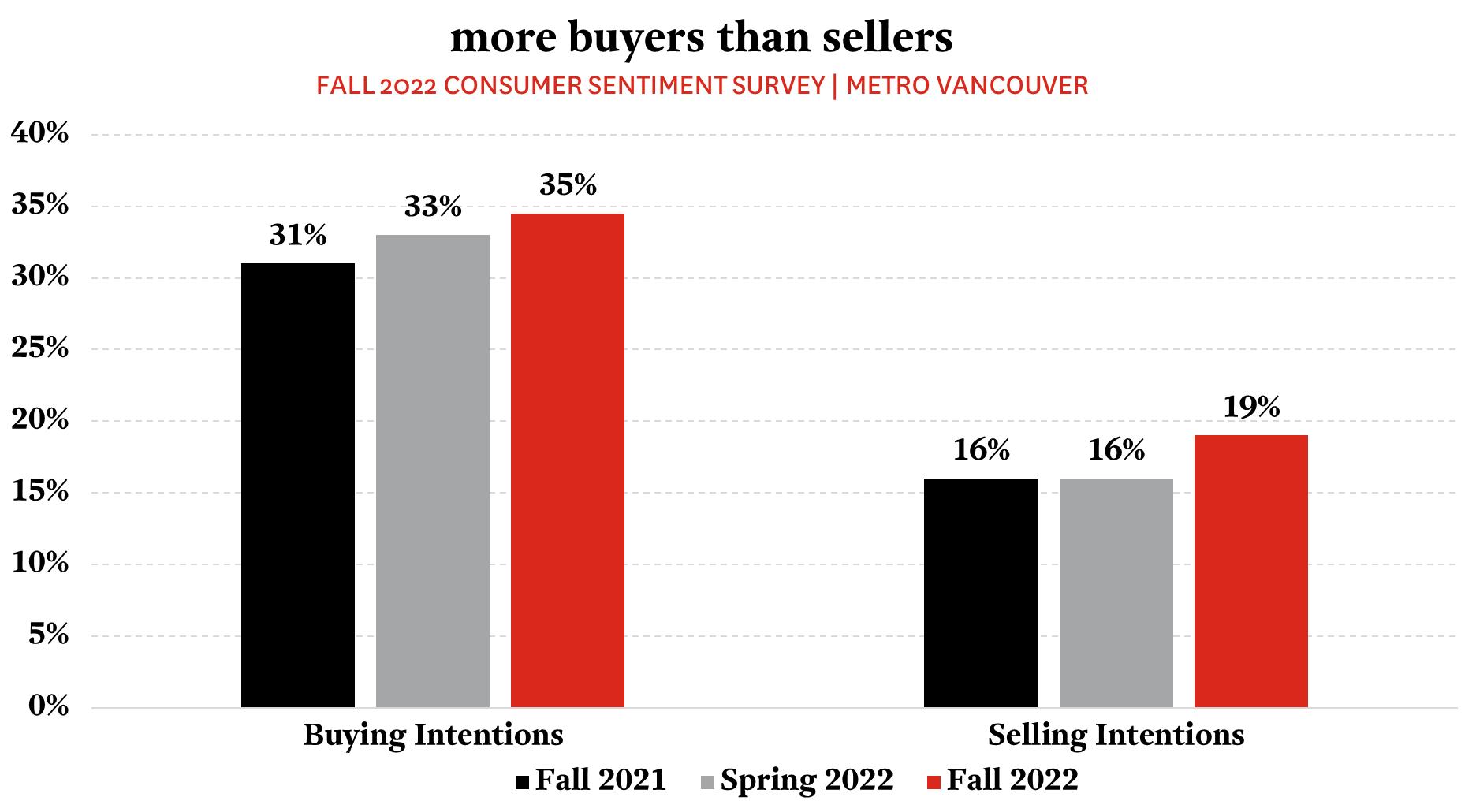

- Survey results show that buying intentions in Metro Vancouver remain robust and continue to outpace selling intentions

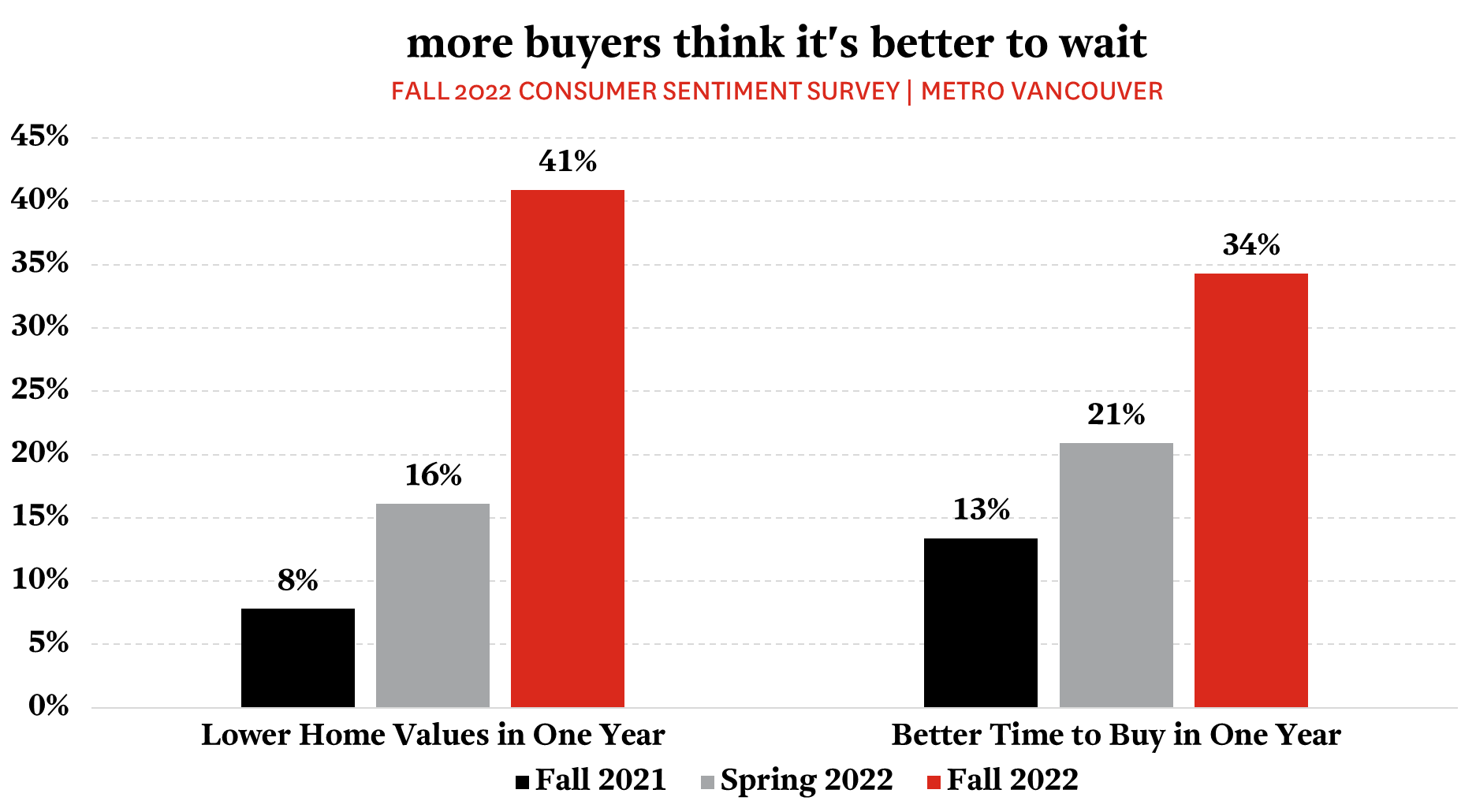

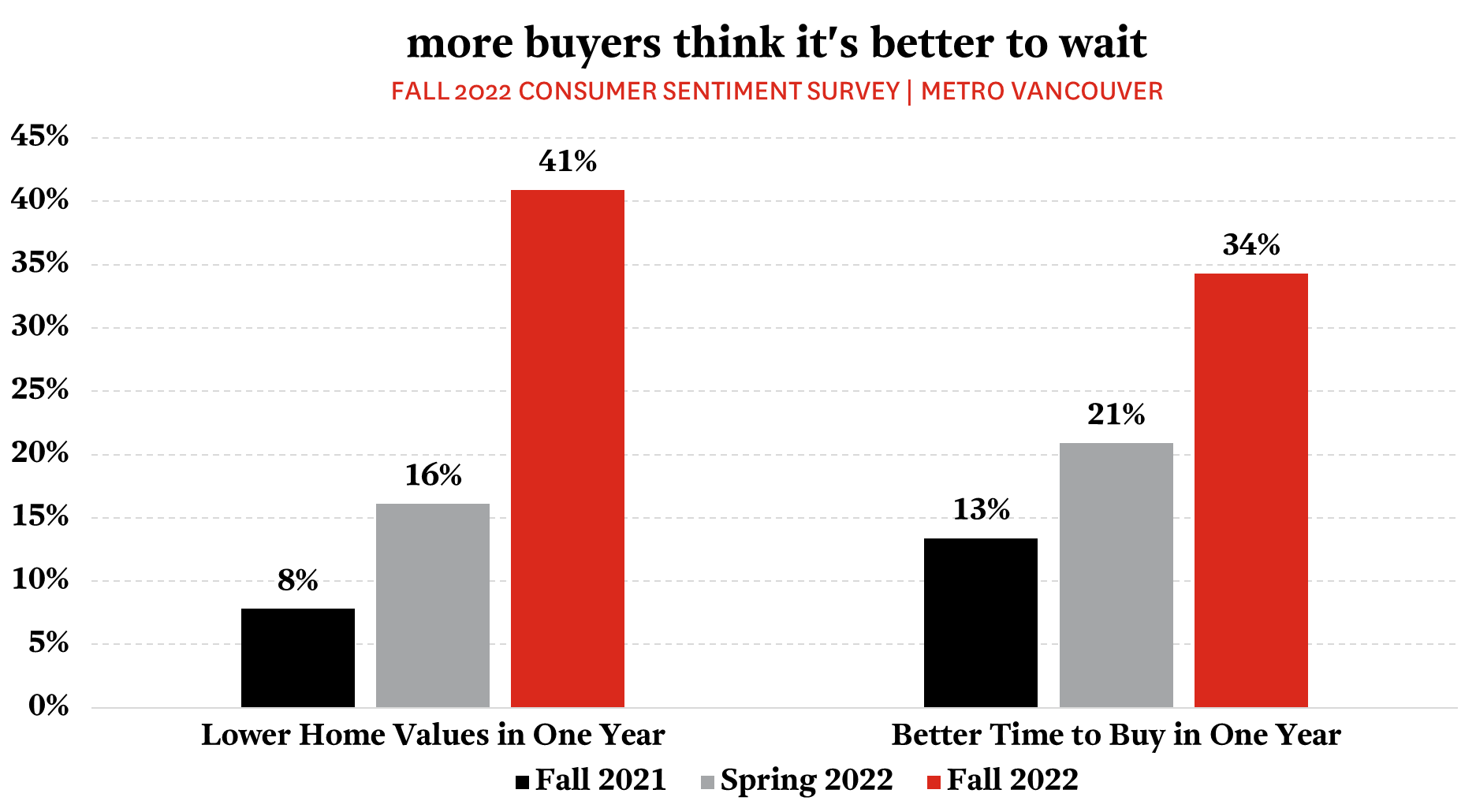

- Respondents increasingly feel buying conditions will be better in one year, and home values will be lower

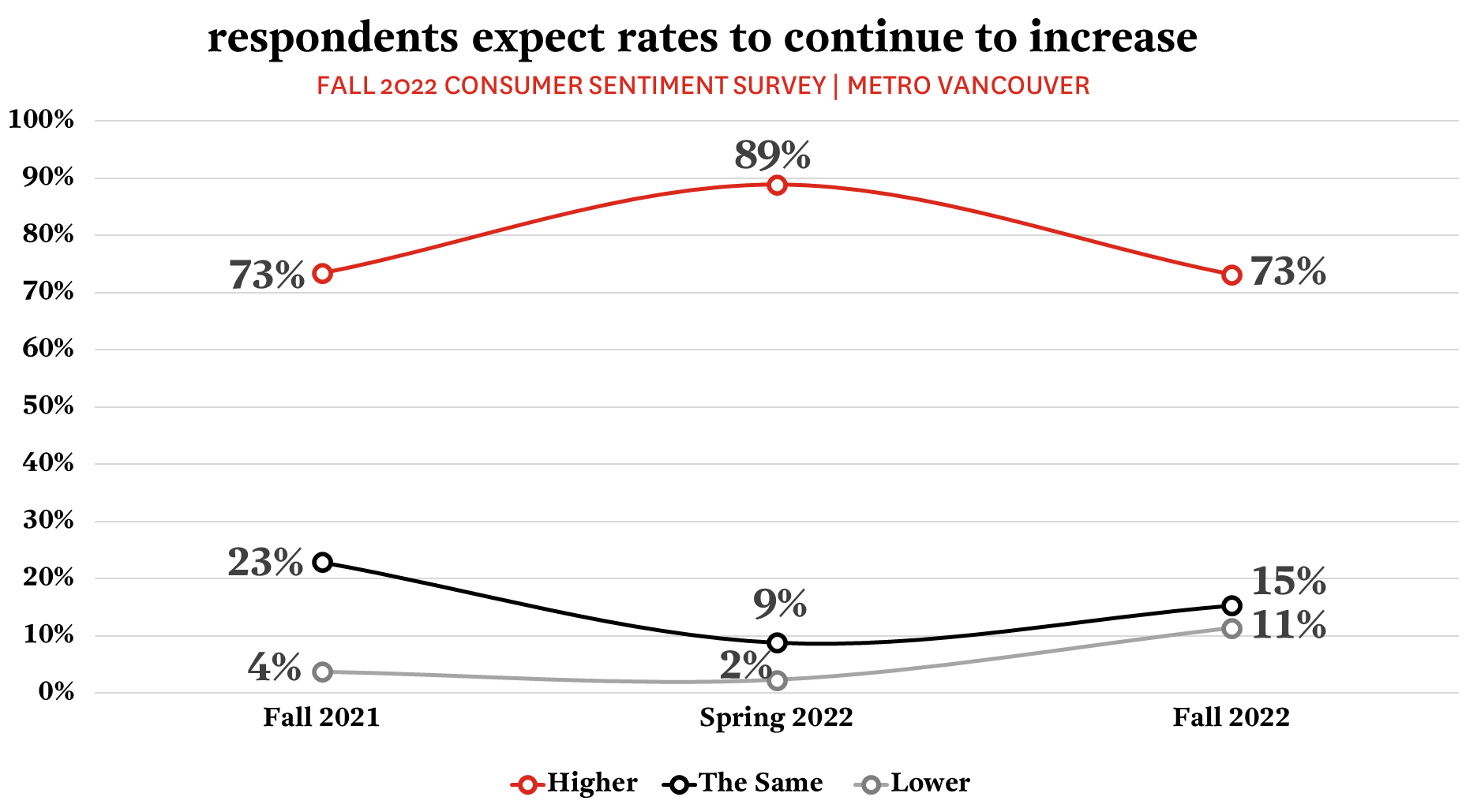

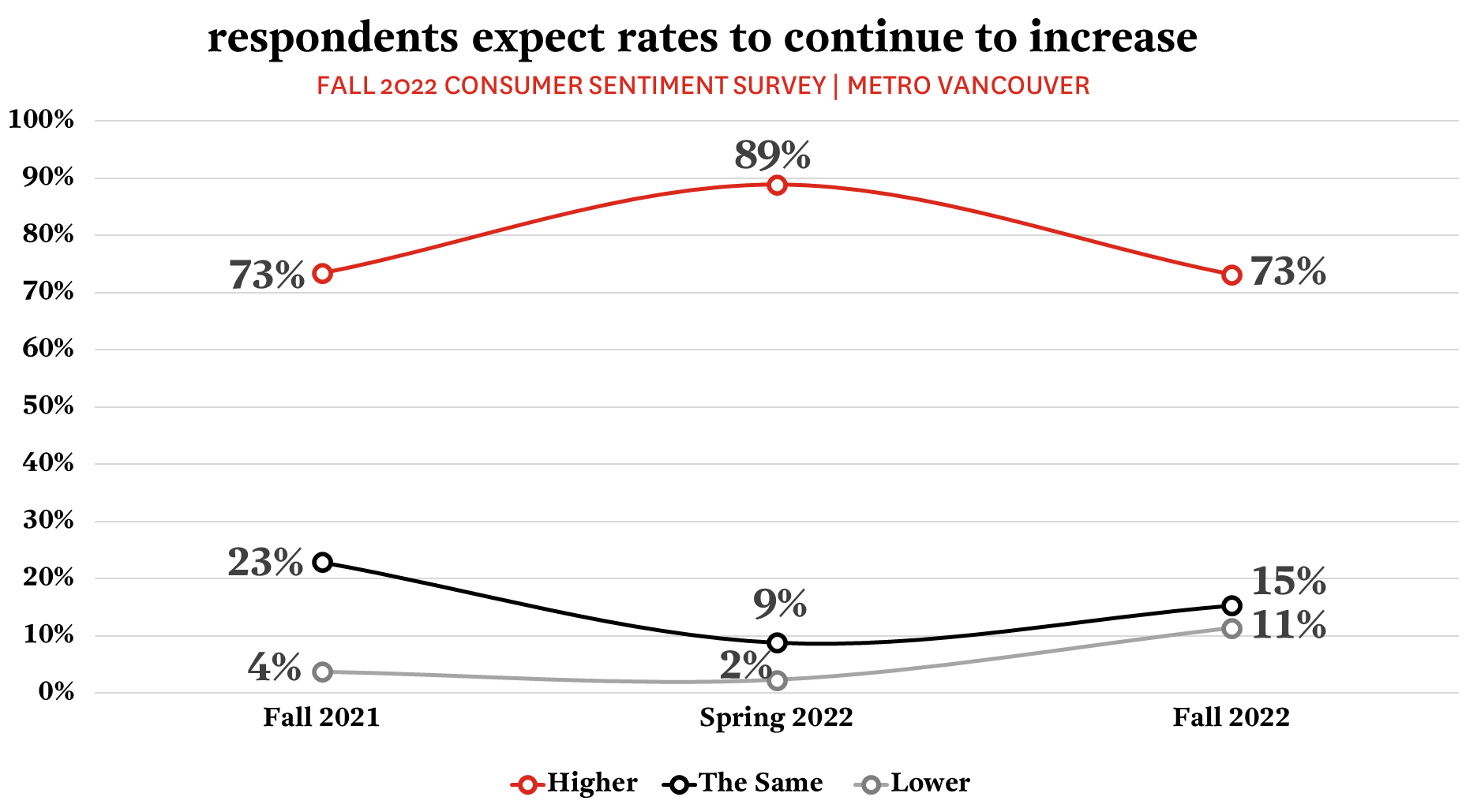

- However, three-quarters of residents think interest rates will be higher in one year than they are today

Our recent survey of Metro Vancouver residents provides insight into their intentions regarding the housing market, in turn offering context for future market activity in this region.THE SURVEY This fall, we completed our third semi-annual survey of consumer sentiment (carried out by

Mustel Group). As part of this, we surveyed 800 adults throughout Metro Vancouver on their views about the housing market, their personal finances, and how changing conditions are influencing their current and future housing-related decisions. Here are some highlights from the survey.

ALMOST 2 POTENTIAL BUYERS FOR EVERY SELLERInterestingly,

owners’ intentions to sell—that is, the proportion of respondents who are either in the process of selling their home or plan to in the next six months—have been relatively consistent over the three iterations of our survey dating back to the fall of 2021, despite significantly changing macroeconomic conditions over that period.

Having said that, selling intentions did rise modestly from 16% in the spring of 2022 to 19% in our most recent survey, though as we’ve noted previously, in today’s market

you’re not selling if you don’t need to.

Intentions to buy a home—which, like selling intentions, includes those who are currently looking to buy as well as those planning to buy in the next six months, have been similarly consistent over the past year, having increased slightly to 35% in our most recent survey, up from each of the past two surveys.

That buying intentions have remained stable (and elevated) reflects the magnitude of the underlying demand for housing in this market, even in the face of high and rising interest rates. Additionally, that there are nearly two potential buyers for every potential seller suggests that there will continue to be more housing demand than supply in the coming months, and this in turn underscores the role of the pre-sale market in filling some of the supply gap.

LET’S DEBATE: BUY NOW OR WAIT?With MLS sales counts having been, shall we say, subdued of late

(Metro Vancouver is actually in the midst of its slowest sales period in a decade), it appears that some proportion of potential buyers are, and have been, sitting on the sidelines in response to today’s challenging market conditions. Now, our survey of Metro Vancouver residents gives us some insight as to why.

Those indicating that they

believe home values will be lower in one year than they are today more than doubled from the spring edition of the survey, to 41% of respondents from 16% (and up from 8% in fall of 2021). Unsurprisingly, we’re seeing a similar increase in the proportion of respondents who

believe that it will be a better time to buy in one year than it is today: this metric is up to 34% in our current survey, up from 21% six months ago and 13% one year ago.

For what it’s worth, our read of the data on past market cycles and the current macroeconomic environment yields an opposite view, however it’s somewhat beside the point whether or not this perspective ultimately aligns with reality, as

intentions govern behaviour. With this in mind, buyers and sellers who have positioned themselves to be nimble so they can adapt quickly to changing market conditions (that is, they have financing in order and they have an established relationship with a trusted realtor, among other things), may find opportunities for themselves sooner than later.

HIGHER RATES AT A LATER DATE?Almost three out of four (73%) survey respondents indicated that t

hey expect interest rates to be higher in one year than they are today. At the same time, a small but growing segment thinks rates will be lower in one year, 11% of respondents indicating as much, versus only 2% in the spring edition of the survey. These views on interest rates are, in turn, having an impact on respondents' views about other aspects of housing and finances, with a growing share expecting home values to decline in the next year (see above) and 41% indicating that higher rates will impact their housing market decisions in the next 12 months.

With the Bank of Canada indicating in its most recent press release that

there is growing evidence that tighter monetary policy is restraining domestic demand, there are some signs that we may be nearing the end of this tightening cycle—though when and where that cycle finishes is up for debate.

Our own perspective is that, among other things,

the Bank of Canada will, in all likelihood, halt their rate hikes in the new year. Once there is some additional clarity on the future interest rate environment, Metro Vancouver residents are indicating an intention to re-engage with the local housing market, which could lead to a recovery sooner than some of us think.

Our rennie intelligence team comprises our in-house demographer, senior economist, and market analysts. Together, they empower individuals, organizations, and institutions with data-driven market insight and analysis. Experts in urban land economics, community planning, shifting demographics, and real estate trends, their strategic research supports a comprehensive advisory service offering and forms the basis of frequent reports and public presentations. Their thoughtful and objective approach truly embodies the core values of rennie.