You Can't Complete What You Don't Start: Vancouver Purpose-Built Rental Homes

May 30, 2022

Written by

Ryan BerlinSHARE THIS

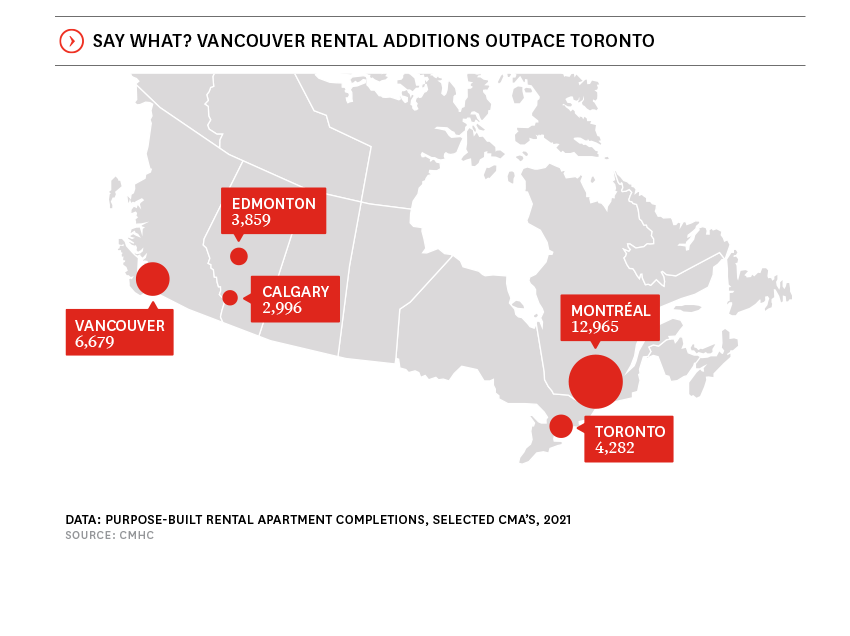

After years of neglect, Metro Vancouver’s purpose-built rental market is finally being tended to through the addition of thousands of new homes.

Written by

Ryan Berlin

Related

the rennie outlook 2026

Our annual compendium of housing, demographic, and economic predictions for the year ahead. Read now >

Feb 2026

Report

tech sector tremors hit seattle

Recent tech layoffs have impacted Seattle, pushing the local unemployment rate above the national.

Feb 2026

Article

5mins read